Insurance companies in India play a vital role in providing financial security and protection to individuals and businesses against various risks.

They offer a wide range of insurance products, including life insurance, health insurance, property insurance, and liability insurance, tailored to meet the diverse needs of customers.

These companies help individuals plan for their future, manage uncertainties, and mitigate financial losses due to unforeseen events such as accidents, illnesses, natural disasters, and legal liabilities.

With a focus on customer-centricity, innovation, and regulatory compliance, insurance companies in India strive to ensure transparency, trust, and reliability in their operations while fostering financial inclusion and stability in the country.

The insurance industry in India has been experiencing steady growth, with an increasing number of people opting for insurance coverage.

According to industry reports, the total insurance adoption (premiums as a percentage of GDP) in India has been on the rise, indicating a growing awareness and acceptance of insurance products among the population.

The Insurance Regulatory and Development Authority of India (IRDAI) regularly releases data on insurance adoption, density, and policyholders’ demographics, providing insights into the expanding reach and impact of insurance companies in the country.

10 Best Insurance Companies in India

Insurance companies in India offer a wide range of insurance products tailored to meet the diverse needs of individuals and businesses.

These products typically include life insurance, health insurance, general insurance (such as motor insurance, property insurance, and liability insurance), and specialized insurance solutions for various industries.

Life insurance policies provide financial protection to policyholders’ families in case of the policyholder’s demise, offering them a lump sum or periodic payments to cover living expenses, debt repayments, education expenses, and more.

Health insurance policies cover medical expenses arising from illnesses, accidents, surgeries, hospitalization, and other healthcare needs.

General insurance policies protect against losses and damages to property, vehicles, and liability claims resulting from accidents or legal disputes.

Insurance companies also offer investment-linked insurance plans that combine insurance coverage with investment opportunities, allowing policyholders to build wealth while ensuring financial security for their loved ones.

These plans may include unit-linked insurance plans (ULIPs) and endowment policies, offering both protection and potential returns on investment.

Here are the list of 10 Best Insurance Companies in India:

Life Insurance Corporation of India (LIC)

The Life Insurance Corporation of India (LIC) has a rich history dating back to 1956 when it was established by an act of Parliament, merging around 245 insurance companies and provident societies.

The primary goal was to nationalize the life insurance industry in India and extend insurance coverage to a larger segment of the population.

LIC began its operations in September 1956 with 5 zonal offices, 33 divisional offices, and 212 branch offices.

Over the years, it expanded its network extensively, reaching even the most remote areas of the country.

This expansion played a crucial role in increasing insurance penetration and providing financial protection to millions of individuals and families across India.

During its journey, LIC introduced various innovative insurance products catering to the diverse needs of its customers.

It played a pivotal role in promoting life insurance as a tool for savings and investment among the Indian populace.

LIC has been a significant contributor to the Indian economy, channeling funds into various sectors through its investments.

It has also played a vital role in supporting the government’s initiatives for social welfare and development.

Over the decades, LIC has evolved into one of the largest life insurance companies globally, with a strong financial position and a wide range of insurance products and services.

It continues to uphold its mission of providing financial security and promoting economic growth in India.

ICICI Prudential Life Insurance Company Limited

ICICI Prudential Life Insurance Company Limited is one of the leading life insurance companies in India.

Established in 2000 as a joint venture between ICICI Bank, a leading private sector bank, and Prudential Corporation Holdings Limited, a leading international financial services group headquartered in the United Kingdom, the company has emerged as a prominent player in the Indian insurance market.

ICICI Prudential Life Insurance offers a wide range of insurance products and services tailored to meet the diverse needs of its customers.

These include protection plans, savings and investment plans, retirement plans, and health insurance solutions. The company aims to provide financial security and peace of mind to individuals and families across India.

With a strong focus on innovation and customer-centricity, ICICI Prudential Life Insurance has introduced various digital initiatives and technological advancements to enhance customer experience and streamline its operations.

It has a robust distribution network comprising bancassurance partners, agents, and online channels, enabling it to reach customers effectively across the country.

The company is committed to transparency, integrity, and ethical business practices, earning the trust and confidence of its customers.

It has received numerous awards and accolades for its performance, customer service, and corporate governance standards.

ICICI Prudential Life Insurance continues to evolve and adapt to the changing needs of its customers and the dynamic insurance landscape in India.

With a strong financial position, innovative products, and a customer-centric approach, it remains a preferred choice for life insurance protection and financial planning solutions.

HDFC Life Insurance Company Limited

HDFC Life Insurance Company Limited is one of the leading life insurance providers in India.

Established in 2000, it is a joint venture between Housing Development Finance Corporation Limited (HDFC), one of India’s largest housing finance companies, and Standard Life Aberdeen plc, a global investment company headquartered in the United Kingdom.

HDFC Life offers a wide range of insurance products and services to meet the diverse needs of its customers.

These include term insurance plans, savings and investment plans, retirement plans, health insurance, and child plans.

The company aims to provide financial protection and security to individuals and families across India.

With a strong focus on innovation and technology, HDFC Life has introduced several digital initiatives to enhance customer experience and streamline its operations.

It has a robust distribution network comprising bancassurance partners, agents, direct sales teams, and online channels, enabling it to reach customers effectively across the country.

HDFC Life is known for its strong financial performance, prudent risk management practices, and customer-centric approach.

It has received numerous awards and accolades for its products, service quality, and corporate governance standards.

The company is committed to transparency, integrity, and ethical business practices, earning the trust and confidence of its customers.

It continues to innovate and adapt to the evolving needs of its customers and the changing insurance landscape in India.

Overall, HDFC Life Insurance Company Limited stands as a trusted partner for individuals and families seeking life insurance protection and financial planning solutions, backed by a legacy of excellence and a commitment to customer satisfaction.

SBI Life Insurance Company Limited

SBI Life Insurance Company Limited is one of India’s leading life insurance providers, established in 2001 as a joint venture between State Bank of India (SBI) and BNP Paribas Cardif, a global insurance company.

With its headquarters in Mumbai, SBI Life offers a comprehensive range of life insurance products and services to cater to the diverse needs of customers across the country.

The company offers various insurance plans including term insurance, savings and investment plans, retirement plans, health insurance, and child plans.

These products are designed to provide financial protection and security to individuals and families, helping them achieve their long-term financial goals.

SBI Life has a wide distribution network that includes SBI’s extensive branch network, bancassurance partners, agents, brokers, and online channels.

This extensive reach enables the company to serve customers from urban centers to rural areas, ensuring accessibility to insurance products for all segments of society.

The company is known for its focus on customer-centricity, innovation, and digitalization.

It has introduced several initiatives to enhance customer experience, including digital onboarding processes, online premium payments, and customer service portals.

SBI Life has consistently maintained strong financial performance and prudent risk management practices, earning the trust and confidence of its policyholders and stakeholders.

The company has received numerous awards and accolades for its products, services, and corporate governance standards.

With a commitment to serving the insurance needs of the nation, SBI Life Insurance Company Limited continues to evolve and adapt to the changing landscape of the insurance industry, while upholding the values of trust, integrity, and transparency.

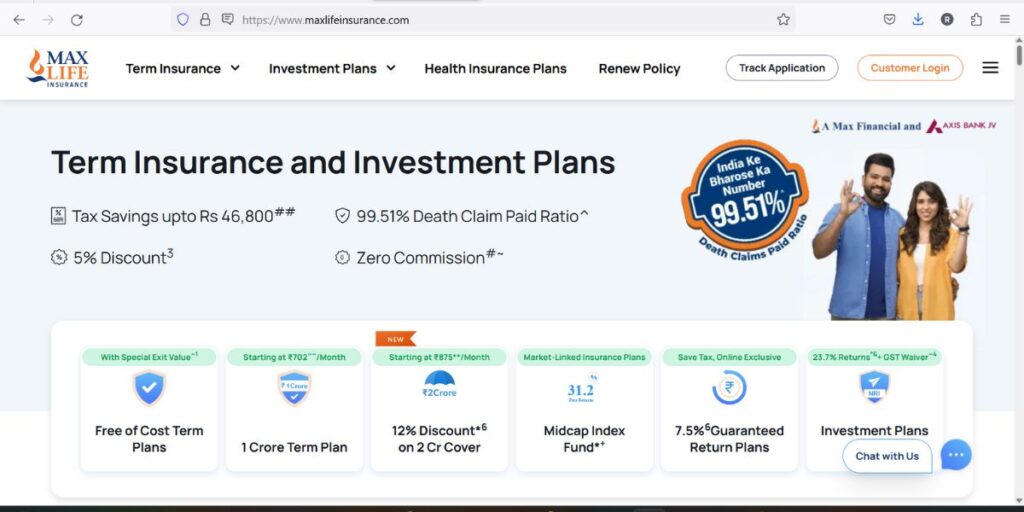

Max Life Insurance Company Limited

Max Life Insurance Company Limited is one of India’s leading life insurance providers, established in 2000 as a joint venture between Max Financial Services Ltd. and Mitsui Sumitomo Insurance Co. Ltd., a global insurance conglomerate.

With its headquarters in Gurugram, Haryana, Max Life offers a wide range of life insurance products and services to cater to the diverse needs of individuals and families across the country.

The company offers various insurance plans including term insurance, savings and investment plans, retirement plans, health insurance, and child plans.

These products are designed to provide financial protection and security, enabling customers to achieve their long-term financial goals and safeguard their loved ones’ future.

Max Life has a robust distribution network comprising bancassurance partners, agents, brokers, and online channels.

This extensive reach allows the company to serve customers from urban centers to rural areas, ensuring accessibility to insurance products for all segments of society.

Max Life is known for its customer-centric approach, innovation, and digitalization efforts.

It has introduced several initiatives to enhance customer experience, including digital onboarding processes, online premium payments, and customer service portals.

The company has consistently demonstrated strong financial performance and prudent risk management practices, earning the trust and confidence of its policyholders and stakeholders.

Max Life has received numerous awards and accolades for its products, services, and corporate governance standards.

With a commitment to delivering value and fostering financial well-being, Max Life Insurance Company Limited continues to innovate and evolve, striving to be a trusted partner in securing the financial future of millions of Indians.

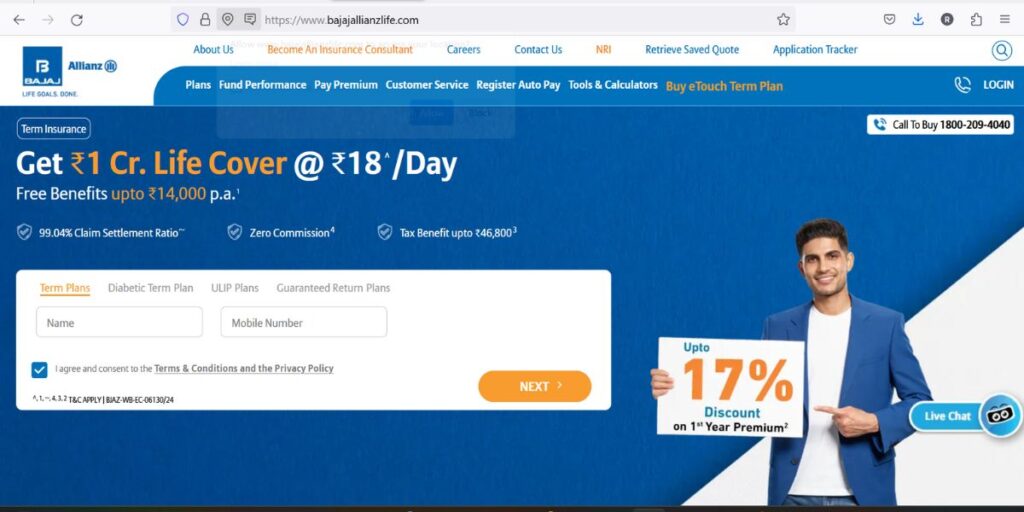

Bajaj Allianz Life Insurance Company Limited

Bajaj Allianz Life Insurance Company Limited is a renowned life insurance provider in India, formed through a joint venture between Bajaj Finserv Limited and Allianz SE, a leading global insurance company.

Established in 2001, Bajaj Allianz Life has since been offering a wide array of life insurance products and services to meet the diverse needs of its customers.

Headquartered in Pune, Maharashtra, Bajaj Allianz Life provides various insurance plans including term insurance, savings and investment plans, retirement plans, health insurance, and child plans.

These offerings are designed to provide financial security and assist individuals in achieving their long-term financial objectives.

The company boasts a widespread distribution network comprising bancassurance partners, agents, brokers, and digital platforms.

This extensive reach ensures that Bajaj Allianz Life’s products are accessible to customers across urban and rural areas, catering to individuals from all walks of life.

Bajaj Allianz Life is committed to innovation and customer-centricity.

The company has embraced digitalization, introducing online policy issuance, premium payments, and customer service portals to enhance the overall customer experience.

With a focus on financial prudence and risk management, Bajaj Allianz Life has maintained strong financial performance over the years.

It has earned the trust of its policyholders and stakeholders through its reliability, transparency, and adherence to ethical business practices.

Recognized for its excellence in product offerings and service delivery, Bajaj Allianz Life Insurance Company Limited continues to strive towards its mission of securing the financial future of its customers and being a trusted partner in their journey towards prosperity.

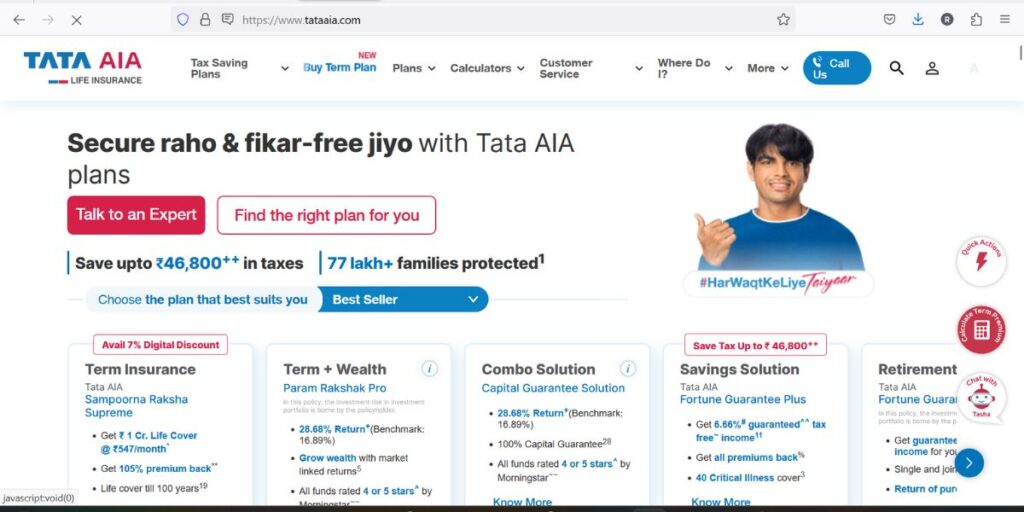

Tata AIA Life Insurance Company Limited

Tata AIA Life Insurance Company Limited is a leading life insurance provider in India, formed as a joint venture between Tata Sons Limited and AIA Group Limited, one of the largest pan-Asian life insurance groups.

Established in 2001, Tata AIA Life has emerged as a trusted partner in financial protection and wealth management for individuals and families across the country.

Headquartered in Mumbai, Maharashtra, Tata AIA Life offers a diverse range of life insurance products and solutions tailored to meet the evolving needs of its customers.

These include term insurance plans, savings and investment plans, retirement solutions, health insurance, and child plans, among others.

Each product is designed to provide financial security, wealth accumulation, and comprehensive protection to policyholders and their loved ones.

Tata AIA Life operates through a robust distribution network comprising bancassurance partners, insurance advisors, brokers, and digital channels.

This extensive reach ensures that its products and services are easily accessible to customers across urban and rural areas, fostering financial inclusion and literacy.

Embracing technology and innovation, Tata AIA Life has introduced digital platforms for policy issuance, premium payments, and customer service, enhancing convenience and accessibility for its policyholders.

The company is committed to delivering superior customer experiences through personalized service and efficient claim settlement processes.

With a strong focus on financial stability and risk management, Tata AIA Life has consistently delivered strong financial performance, earning the trust and confidence of its stakeholders.

It upholds the values of integrity, transparency, and customer-centricity in all its operations, striving to make a positive difference in the lives of its policyholders and the communities it serves.

Recognized for its excellence in product innovation, service delivery, and corporate governance, Tata AIA Life Insurance Company Limited continues to set benchmarks in the Indian life insurance industry.

Committed to its mission of protecting and enriching the lives of its customers, Tata AIA Life remains dedicated to providing holistic and sustainable insurance solutions for generations to come.

Reliance Nippon Life Insurance Company Limited

Reliance Nippon Life Insurance Company Limited, often referred to as Reliance Life Insurance, is one of the prominent life insurance providers in India.

Established in 2001, it is a joint venture between Reliance Capital Limited and Nippon Life Insurance, one of Japan’s largest life insurance companies.

Over the years, Reliance Life Insurance has earned a reputation for its commitment to customer-centricity, innovation, and financial strength.

Headquartered in Mumbai, Maharashtra, Reliance Life Insurance offers a wide range of life insurance products to cater to the diverse needs of its customers.

These products include term insurance plans, savings and investment plans, child plans, retirement solutions, and health insurance policies.

Each product is designed to provide financial security, wealth accumulation, and protection to policyholders and their families.

Reliance Life Insurance operates through an extensive network of branches, agents, bancassurance partners, and digital channels, ensuring widespread access to its products and services across India.

The company emphasizes the use of technology to enhance customer experience, streamline processes, and offer innovative solutions.

Committed to financial prudence and risk management, Reliance Life Insurance has maintained a strong financial performance, reflecting its robust business fundamentals and adherence to regulatory norms.

It has a proven track record of prompt and fair claim settlements, providing peace of mind to its policyholders during times of need.

In addition to its focus on customer service and financial stability, Reliance Life Insurance actively engages in corporate social responsibility initiatives to contribute to the welfare of society.

These initiatives encompass areas such as education, healthcare, environmental sustainability, and community development.

With a vision to be the most preferred life insurance provider in India, Reliance Nippon Life Insurance Company Limited continues to innovate and evolve to meet the changing needs of its customers.

By combining financial expertise, technological innovation, and a commitment to social responsibility, Reliance Life Insurance aims to empower individuals and families to secure their financial future and lead fulfilling lives.

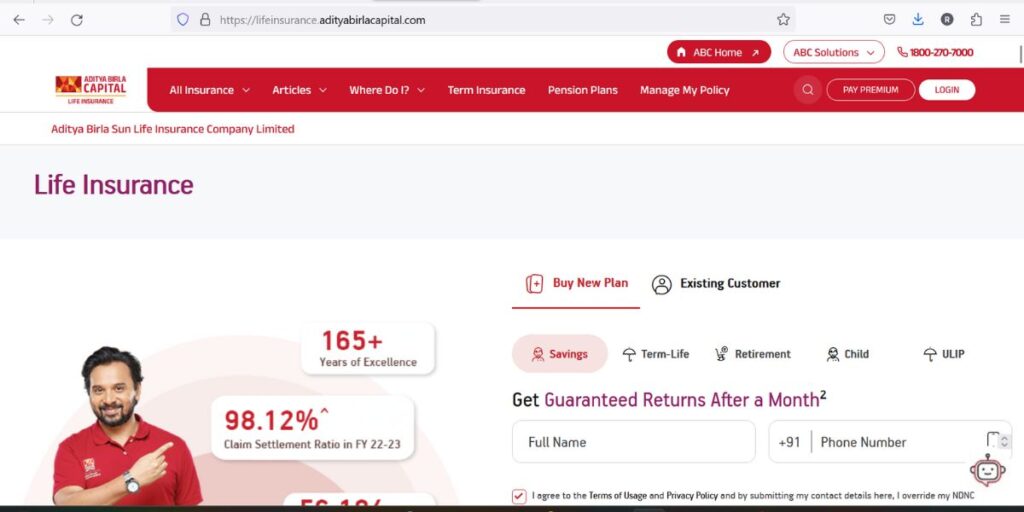

Aditya Birla Sun Life Insurance Company Limited

Aditya Birla Sun Life Insurance Company Limited, commonly known as ABSLI, is a prominent life insurance provider in India.

Established in 2000, it is a joint venture between the Aditya Birla Group, a leading conglomerate in India, and Sun Life Financial Inc., a leading international financial services organization based in Canada.

ABSLI offers a diverse range of life insurance products and solutions to meet the evolving needs of its customers.

These include term insurance plans, savings and investment plans, retirement solutions, child plans, health insurance policies, and group insurance plans.

Each product is designed to provide financial protection, wealth accumulation, and security to policyholders and their families.

Headquartered in Mumbai, Maharashtra, ABSLI operates through a vast network of branches, agents, bancassurance partners, and digital platforms, ensuring widespread accessibility of its products and services across the country.

The company places a strong emphasis on customer-centricity, innovation, and technological advancement to enhance the overall customer experience.

ABSLI is committed to financial prudence and transparency, maintaining high standards of corporate governance and risk management practices.

It has a robust claims settlement process, ensuring prompt and fair claim settlements to provide peace of mind to its policyholders during times of need.

In addition to its core business operations, ABSLI is actively involved in various corporate social responsibility initiatives aimed at contributing to the welfare of society.

These initiatives focus on areas such as education, healthcare, environmental sustainability, and community development, reflecting the company’s commitment to social responsibility and sustainable development.

With a vision to be a trusted life insurance partner for its customers, Aditya Birla Sun Life Insurance Company Limited continues to innovate and evolve, leveraging its strong financial foundation, industry expertise, and customer-centric approach to deliver value-added solutions and services.

Through its unwavering commitment to excellence and integrity, ABSLI aims to empower individuals and families to secure their financial future and achieve their life goals.

Kotak Mahindra Life Insurance Company Limited

Kotak Mahindra Life Insurance Company Limited is a leading life insurance provider in India.

Established in 2001, it is a subsidiary of Kotak Mahindra Bank, one of India’s top private sector banks.

The company operates with a mission to offer innovative life insurance solutions that cater to the diverse needs of its customers.

Kotak Mahindra Life Insurance offers a wide range of life insurance products and services, including term plans, savings and investment plans, retirement solutions, child plans, and health insurance policies.

These products are designed to provide financial security, wealth creation, and protection against life’s uncertainties.

The company adopts a customer-centric approach, focusing on understanding the unique requirements of its customers and providing them with tailored solutions.

Through its extensive network of branches, agents, and digital platforms, Kotak Mahindra Life Insurance ensures easy access to its products and services across India.

Kotak Mahindra Life Insurance emphasizes transparency, integrity, and professionalism in its operations.

It adheres to stringent standards of corporate governance and risk management to safeguard the interests of its policyholders and stakeholders.

The company is committed to driving innovation and leveraging technology to enhance the overall customer experience.

It continually updates its product offerings and services to meet the evolving needs of its customers in today’s dynamic environment.

Kotak Mahindra Life Insurance is also actively involved in various corporate social responsibility initiatives aimed at contributing to the welfare of society.

These initiatives focus on areas such as education, healthcare, environmental sustainability, and community development, reflecting the company’s commitment to making a positive impact on society.

With a strong financial foundation, customer-centric approach, and a commitment to excellence, Kotak Mahindra Life Insurance Company Limited continues to be a trusted partner for individuals and families seeking to secure their financial future and achieve their life goals.

How to choose Best Insurance Companies in India?

To pick the best insurance company in India, start by knowing what type of insurance you need, like health, life, or auto insurance.

Then, look into the reputation and financial stability of the insurance companies you’re interested in.

Check how well they handle claims and treat their customers. Also, compare the costs, coverage options, and policy details from different insurers.

Read reviews from other customers and ask friends or family for their recommendations.

Lastly, make sure the company has a network of hospitals or service centers that are convenient for you.