A business loan is a financial product provided by banks, financial institutions, or online lenders to entrepreneurs and businesses to support their financial needs.

Business loans are typically used for various purposes, such as starting a new business, expanding an existing one, purchasing equipment or inventory, hiring employees, or managing cash flow.

These loans come with specific terms, interest rates, and repayment plans that borrowers agree to when they take out the loan.

Business Loans for Bad Credit

Business loans for bad credit are special types of financial help for businesses that may not have a good credit history.

When a business has a low credit score, it can be tough to get a traditional loan. However, there are lenders who understand this and offer alternative options.

These loans might have higher interest rates or different terms, but they can provide the necessary funds for businesses that need support.

Some options include short-term loans for quick cash, using invoices for financing, or even using business or personal assets as collateral.

While these loans can be helpful, businesses should be cautious, as they might come with higher costs.

types of business loans

There are various types of business loans designed to meet different financial needs of entrepreneurs and businesses. Here are some common types:

What Increases your Total Loan Balance?

What is a subsidized loan? Is it Better?

What is an FHA Loan? How does it work?

Which loan is best for business?

Among the various types of business loans, the choice depends on the specific needs and circumstances of the business. For businesses looking to establish or expand, a term loan could be the most suitable option.

Term loans are well-suited for established businesses seeking funds for significant investments, such as expansions or equipment purchases.

These loans come with fixed repayment terms, providing businesses with a clear structure for managing their finances.

The decision to opt for a term loan should be based on a careful evaluation of the business’s financial situation and the purpose for which the funds are required.

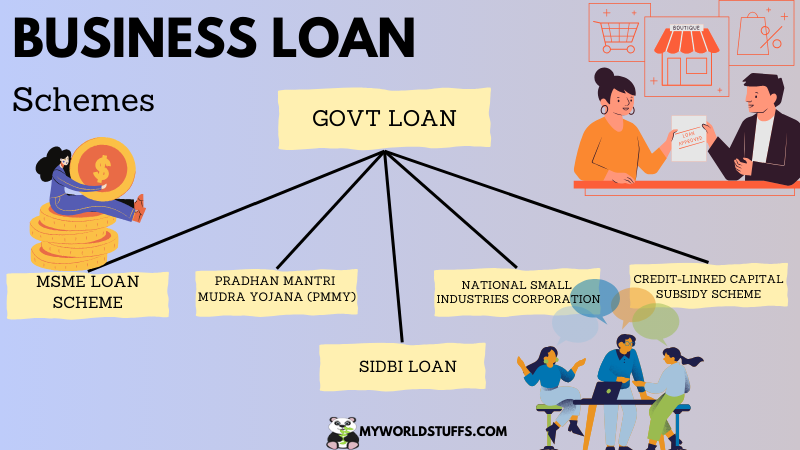

business loan by government

The Indian government has various schemes and initiatives to provide financial support to businesses through loans.

These initiatives are often part of broader government programs aimed at promoting entrepreneurship, economic growth, and job creation.

- Pradhan Mantri Mudra Yojana (PMMY): This scheme provides loans to micro and small enterprises. It is categorized into three stages – Shishu, Kishor, and Tarun – based on the business’s stage of development.

- Credit Guarantee Fund Scheme for Micro and Small Enterprises (CGTMSE): This scheme facilitates collateral-free credit for micro and small enterprises by providing a credit guarantee cover to banks and financial institutions.

- Stand-Up India Scheme: Aimed at promoting entrepreneurship among women and Scheduled Caste (SC) or Scheduled Tribe (ST) communities, this scheme offers bank loans to set up greenfield enterprises in the manufacturing, services, or trading sectors.

- SIDBI Make in India Soft Loan Fund for Micro, Small, and Medium Enterprises (SMILE): This initiative by SIDBI provides soft loans to MSMEs for modernization, technology upgradation, and expansion.

- National Small Industries Corporation (NSIC) Subsidy Schemes: NSIC offers various schemes with financial assistance and support to small-scale industries.

Before applying for any government business loan, it is advisable to thoroughly review the eligibility criteria, terms, and conditions of the specific scheme.

Eligibility

- Business Type: Sole proprietorship, partnership, private limited company, or other legal entities.

- Business Vintage: Typically operational for a minimum period (e.g., 1-3 years).

- Credit Score: A good credit history often enhances eligibility.

- Annual Turnover: Minimum and maximum turnover criteria may apply.

- Profitability: A track record of profitability is favorable.

- Industry Type: Some sectors may be prioritized or restricted.

- Loan Purpose: Clearly defined purpose for the loan.

- Collateral: Secured loans may require assets as collateral.

- Documentation: Complete and accurate financial documents.

- Compliance: Adherence to statutory and regulatory requirements.

- Repayment Capacity: Ability to repay the loan, assessed through financial statements.

- Creditworthiness: Overall financial health and reliability of the business.

| Name | Loan Amount | Interest Rate(p.a) | |

|---|---|---|---|

| Axis Bank | 300000 | 15.5% onwards | 12 – 36 |

| Bajaj Finserv | 300000 | 18% onwards | 12 – 48 |

| Capital First Prime | 100000 | 21% onwards | 12 – 36 |

| Fullerton Finance | 100000 | 17% onwards | 12 – 48 |

| HDB Financial Services Ltd. | 75000 | 18% onwards | 12 – 60 |

| HDFC Bank | 100000 | 13% onwards | 6 – 48 |

| Hero FinCorp | 300000 | 18% onwards | 12 – 36 |

| ICICI Bank | 100000 | 13% onwards | 6 – 48 |

| IIFL Finance | 100000 | 18% onwards | 12 – 36 |

| Indifi Finance | 50000 | 18% onwards | 12 – 36 |

| Kotak Mahindra Bank | 500000 | 16% onwards | 6 – 48 |

| Lendingkart Finance | 50000 | 18% onwards | 3 – 36 |

| NeoGrowth Finance | 200000 | 21% onwards | 6 – 24 |

| PaySense Services India Pvt. Ltd. | 5000 | 18% onwards | 3 – 36 |

| RBL Bank | 250000 | 18% onwards | 12 – 36 |

| Tata Capital Finance | 100000 | 18% onwards | 12 – 36 |

| ZipLoan | 100000 | 18% onwards | 6 – 24 |

| Allahabad Bank | 0 | 9.20% onwards | |

| Andhra Bank | 0 | 10.80% onwards | |

| Axis Bank | 50000 | 12% onwards | |

| Bajaj Finserv | 0 | 12.99% onwards | |

| Bank of Baroda | 50000 | 10.25% onwards | |

| Bank of India | 0 | 9.35% onwards | |

| Bank of Maharashtra | 0 | 10.85% onwards | |

| CASHe | 9000 | 33% to 36% | |

| Central Bank | 0 | 8.45% onwards | |

| Citibank | 10000 | 9.99% onwards | |

| Early Salary | 8000 | 24% onwards | |

| Federal Bank | 0 | 11.49% onwards | |

| Fullerton India | 0 | 11.99% onwards | |

| HDFC Bank | 50000 | 10.75% onwards | |

| Home Credit | 25000 | 24% onwards | |

| HSBC Bank | 0 | 10.50% onwards | |

| ICICI Bank | 50000 | 11.25% onwards | |

| IDBI Bank | 25000 | 12% onwards | |

| IDFC First | 100000 | 10.75% onwards | |

| Indiabulls | 1000 | 13.99% onwards | |

| Indian Bank | 0 | 9.20% onwards | |

| Indian Overseas Bank | 0 | 10.30% onwards | |

| IndusInd Bank | 50000 | 11% onwards | |

| Kotak Mahindra Bank | 50000 | 10.75 onwards | |

| Kreditbee | 1000 | 1.02% p.m. onwards | |

| Moneytap | 3000 | 1.25% p.m. onwards | |

| Moneyview | 10000 | 1.33% p.m. onwards | |

| Muthoot Finance | 0 | 15% onwards | |

| Punjab National Bank | 25000 | 8.95% onwards | |

| RBL Bank | 100000 | 14% onwards | |

| Standard Chartered Bank | 100000 | 11.00% onwards | |

| State Bank of India | 0 | 9.60% onwards | |

| TATA Capital | 75000 | 10.99% onwards | |

| UCO Bank | 0 | 9.75% onwards | |

| Union Bank of India | 0 | 8.90% onwards | |

| Yes Bank | 100000 | 10.75% onwards | |

| Axis Bank | 0 | 15.20% | |

| Axis Bank | 400000 | 14.70% | |

| Axis Bank | 750000 | 13.70% | |

| Bank of Baroda | 0 | 8.50% onwards | |

| Canara Bank | 0 | 6.60% | |

| Canara Bank | 0 | 10.40% | |

| Canara Bank | 400000 | 10.40% | |

| Canara Bank | 750000 | 10.20% | |

| Canara Bank | 0 | 9.90% | |

| HDFC Bank | 0 | 9.00% | |

| HDFC Bank | 0 | 13.86% | |

| HDFC Bank | 0 | 11.57% | |

| Kotak Mahindra Bank | 0 | 11.5% to 24% | |

| Punjab National Bank | 0 | 8.55% onwards | |

| Punjab National Bank | 0 | 10.30% onwards | |

| Punjab National Bank | 0 | 8.45% onwards | |

| Punjab National Bank | 0 | 8.55% onwards | |

| Punjab National Bank | 0 | 10.45% | |

| State Bank of India | 0 | 10.25% | |

| State Bank of India | 750000 | 10.50% | |

| Avanse | 0 | 10% to 16.50% | |

| Credila | 0 | 11.85% onwards | |

| CitiBank | 8.80% onwards | ||

| Syndicate Bank | 11.50% onwards | ||

| HDFC Ltd. | 9.50% onwards | ||

| State Bank of India | 9.60% onwards | ||

| Kotak Mahindra Bank | 9.60% onwards | ||

| ICICI Bank | 9.80% onwards | ||

| IDBI Bank | 10.10% onwards | ||

| Bajaj Finserv | 10.10% onwards | ||

| PNB Housing Finance Ltd. | 10.25% onwards | ||

| Tata Capital | 10.50% onwards | ||

| LIC Housing Finance Ltd. | 11.30% onwards | ||

| Axis Bank | 11.35% onwards | ||

| PaySense | 18% to 36% p.a. | ||

| Rupeelend | 30% for 30 days | ||

| CASHe | 1.75% onwards for 15-day loan | ||

| CASHe | 3.25% onwards for 30-day loan | ||

| CASHe | 2.75% onwards (monthly) for 90-day loan | ||

| CASHe | 2.50% per month for 180-day loan | ||

| Money View | 1.33% – 2% p.m. | ||

| Credy | 1% – 1.5% p.m. | ||

| EarlySalary | 2.5% p.m. | ||

| LazyPay | 15% – 32% p.a. | ||

| mPokket | Based on lender’s terms | ||

| MoneyinMinutes | 0.1% – 0.7% per day | ||

| QuickCredit | 1% per day | ||

| FlexSalary | Up to 3% per month | ||

How to apply business loan?

- Explore online lenders, banks, and financial institutions.

- Compare interest rates, terms, and customer reviews.

- Review eligibility criteria on the lender’s website.

- Ensure your business meets the required conditions.

- Gather necessary documents, including financial statements, business plans, and legal papers.

- Scan or digitize these documents for online submission.

- Visit the lender’s website and create an account if required.

- Provide necessary business and personal information.

- Complete the online application form.

- Input accurate details about your business, financials, and loan requirements.

- Upload the scanned or digitized documents as per the lender’s requirements.

- Ensure all required information is provided.

- Review the application for accuracy.

- Submit the application and documents through the online portal.

- Allow time for the lender to review your application.

- Check your email or account for updates or requests for additional information.

- Once approved, carefully review the loan terms and conditions.

- Understand interest rates, repayment schedules, and any associated fees.

- If satisfied, accept the loan offer electronically.

- Sign any necessary agreements through the online platform.

- After acceptance, the funds will be disbursed directly to your business account.

- Monitor your account for fund arrival.

frequently asked questions

What is a business loan?

A business loan is a financial product that provides funds to businesses for various purposes such as expansion, working capital, equipment purchase, or other business needs.

How can I qualify for a business loan?

Eligibility criteria vary among lenders, but typically include factors like creditworthiness, business profitability, industry type, and the purpose of the loan.

What documents are required for a business loan?

Commonly required documents include business financial statements, tax returns, business plans, identification proof, and legal business documents.

How much can I borrow for my business?

Loan amounts vary based on factors like the lender, your business’s financial health, and the purpose of the loan. Lenders often have minimum and maximum loan limits.

How long does it take to get a business loan approved?

Approval times vary. Online lenders may provide quicker decisions, while traditional banks may take longer. Preparing all necessary documents in advance can expedite the process.

Can I get a business loan with bad credit?

Some lenders offer business loans for individuals with less-than-perfect credit, but the terms may be less favorable. It’s advisable to work on improving your credit score before applying.

Can I use a business loan for any purpose?

While business loans are versatile, lenders often specify the purpose of the loan. Common uses include working capital, equipment purchase, expansion, and debt consolidation.

How do I repay a business loan?

Repayment terms vary. Typically, businesses make regular payments, either monthly or according to the agreed schedule. Automatic payments can be set up for convenience.