A secured loan is a type of loan that is backed by collateral, which is an asset that the borrower pledges to the lender as a security for the loan.

The collateral serves as a form of protection for the lender in case the borrower fails to repay the loan according to the agreed-upon terms.

A secured loan is a type of loan that is backed by collateral, which is an asset that the borrower pledges to the lender as a security for the loan.

The collateral serves as a form of protection for the lender in case the borrower fails to repay the loan according to the agreed-upon terms.

Common examples of secured loans include:

- Mortgage: Home loans are a common type of secured loan where the property being purchased serves as collateral. If the borrower fails to make the mortgage payments, the lender can take possession of the property through a legal process called foreclosure.

- Auto Loan: When you finance the purchase of a vehicle, the car itself is often used as collateral. If the borrower defaults on the loan, the lender may repossess the vehicle.

- Secured Personal Loan: Some personal loans are secured by valuable assets such as savings accounts, certificates of deposit (CDs), or other property owned by the borrower.

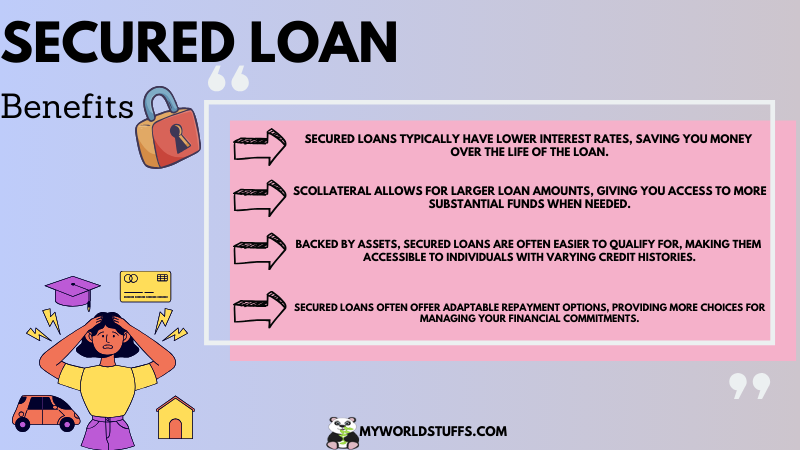

The presence of collateral typically allows borrowers to qualify for larger loan amounts and lower interest rates compared to unsecured loan.

However, it also means that if the borrower is unable to repay the loan, the lender has the right to seize the collateral to recover the outstanding balance.

Secured loan Meaning

A secured loan is a type of loan where you put up something valuable, like your house or car, as a guarantee that you will repay the money you borrowed. If you can’t repay, the lender can take that valuable thing to recover the money.

how does a secured loan work?

When you need to borrow money, you offer something valuable, like your house or car, as a guarantee to the lender. This valuable item is called collateral.

The lender looks at your application, checks your ability to repay the loan, and decides if they approve. If approved, they set the terms of the loan, including the interest rate and how you’ll pay it back.

Once everything is agreed upon, they give you the money. You then repay the loan according to the agreed schedule. If you can’t make the payments, the lender can take the valuable thing you offered (collateral) as a way to get back the money you owe them.

Once you’ve repaid everything, including interest and fees, you get to keep your valuable item, and the loan is considered complete.

Types of Secured Loan

There are various types of secured loans, each tailored to specific purposes and assets. Here are some common types of secured loans:

secured loan interest rates

| Indian Banks | Loan against Property Interest Rates | Gold Loan Interest Rates | Business Loan Interest Rates |

| HDFC Bank | 9.50% p.a. – 11.00% p.a. | 8.50% p.a. – 17.30% p.a. | 10.00% p.a. – 22.50% p.a. |

| Axis Bank | 10.50% p.a. – 10.95% p.a. | 17% p.a. – 19% p.a. | 11% p.a. – 25% p.a. |

| SBI Bank | 10.00% p.a. – 11.55% p.a. | 8.70% p.a. – 9.50% p.a. | 9.00% p.a. onwards |

| ICICI Bank | 10.85% p.a. – 12.50% p.a. | 10.00% p.a. – 17.95% p.a. | At the discretion of the bank |

| PNB Housing Finance | 9.25% p.a. – 12.45% p.a. | 9.25% p.a. | At the discretion of the bank |

- Collateral: Provide a valuable asset (e.g., home, car, savings) as security for the loan.

- Creditworthiness: Lenders assess your credit history and financial situation to determine eligibility.

- Loan Amount: Specify the amount of money you need and the purpose of the loan.

- Loan Terms: Agree on repayment terms, including interest rates, monthly payments, and the loan duration.

- Application: Submit a loan application with personal and financial information.

- Approval: Lender reviews your application, assesses the collateral, and decides whether to approve the loan.

- Disbursement: Upon approval, the lender releases the loan amount to you.

- Repayment Schedule: Follow the agreed-upon schedule to repay the loan over time.

- Risk of Collateral Loss: Understand that failure to repay may result in the lender seizing the collateral.

- Completion: Repay the entire loan amount, including interest and fees, to complete the loan.

- Age: Must be 18 years or older.

- Residence: Applicant must be a resident of India.

- Eligible Applicants: NRIs, NROs, NREs, self-employed, professionals, business organizations, farmers, and HUFs.

- Minimum Annual Income: Typically, a minimum annual income of Rs.3 lakh is required.

- Income Sources: Acceptable income sources include regular salary, non-salaried income, and business income.

- Business Stability: For business income-based loans, the business must have been profitable for the last 3 years.

- Asset Requirement: Applicant must possess assets, the value of which matches or exceeds the loan amount.

- Credit score

- Mortgage Loan:

- Proof of identity, age, income, and residence.

- Original property documents.

- Bank statements for the last 6 months.

- Optional: Guarantor, copy of lease agreement for LRD.

- Car Loan:

- Proof of age, identity, income, and residence.

- Duly filled application form.

- Passport-sized photographs.

- Bank statements for the last 6 months.

- Verified proof of signature.

- Home Loan:

- Proof of residence, identity.

- Bank statements for the last 6 months.

- Optional: Guarantor, credit score.

- Business Loan:

- Company profile, promoter profile.

- Audited balance sheets for the last 3 years.

- Proof of residence and identity.

Application Process for Secured Loans

- Visit the bank’s or NBFC’s physical location or website.

- Fill out the application, often available online.

- Provide KYC documents like Aadhaar and PAN cards.

- Submit income documentation to support the loan application.

- Submit any additional paperwork as required.

- The loan is disbursed promptly if all paperwork is in order.

frequently asked questions

How does the loan approval process work?

The lender assesses the borrower’s creditworthiness, the value of the collateral, and the purpose of the loan. Once approved, the terms, including interest rates and repayment schedule, are agreed upon.

What happens if I can’t repay the loan?

If you default on a secured loan, the lender has the right to seize the collateral to recover the outstanding balance. It’s crucial to communicate with the lender if facing difficulties and explore potential solutions.

What are the typical interest rates for secured loans?

Interest rates vary based on factors like the borrower’s creditworthiness, the loan amount, and the type of collateral. Rates are generally lower than those for unsecured loans due to the reduced risk for the lender.

Can I apply for a secured loan with bad credit?

While having collateral can increase approval chances, a low credit score may still affect the interest rate offered. Some lenders specialize in providing secured loans to individuals with less-than-perfect credit.

Can I prepay a secured loan?

Many lenders allow borrowers to prepay or repay the loan before the scheduled term. However, some loans may have prepayment penalties, so it’s important to check the terms of the loan agreement.