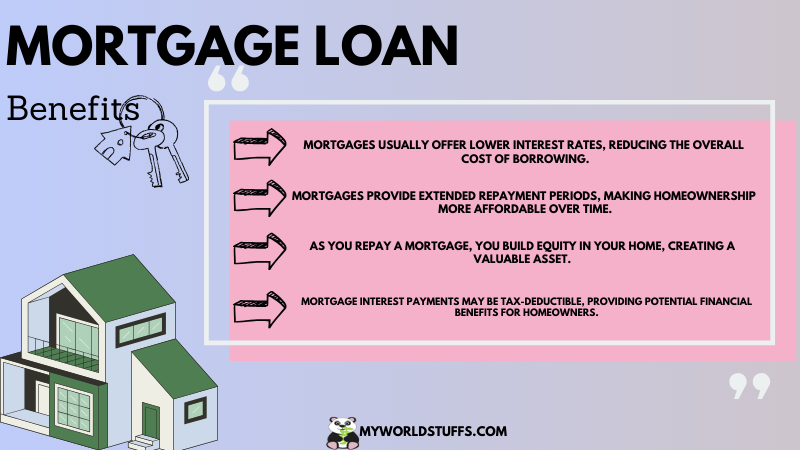

A mortgage is like a special kind of loan that you get when you want to buy a house. Most people don’t have all the money to buy a house at once, so they go to a bank for a mortgage.

The bank lends them the money to buy the house, and in return, they agree to pay the bank back in smaller amounts every month for a long time, often many years.

The house itself serves as a kind of guarantee for the bank, if the person can’t make the payments, the bank might take the house back.

So, a mortgage is a way for people to own a house without having to pay for it all at the beginning.

Mortgage meaning in banking

In banking, a mortgage refers to a specific type of loan used for purchasing real estate, typically a home.

When individuals or businesses want to buy property but don’t have the full amount in cash, they can approach a bank or a lending institution for a mortgage.

The bank provides the necessary funds, allowing the borrower to acquire the property.

In return, the borrower agrees to repay the loan in regular installments over an extended period, usually spanning many years.

The property itself serves as collateral, which means that if the borrower fails to make the payments as agreed, the bank has the right to take possession of the property through a legal process known as foreclosure.

Mortgage meaning in Business

In the context of business, a mortgage typically refers to a financial arrangement where a company or business entity borrows money from a bank or lending institution to purchase or refinance real estate for commercial purposes.

This real estate could include office buildings, warehouses, retail spaces, or other properties used in the operations of the business.

The mortgage serves as a loan agreement, outlining the terms and conditions for repayment, including the loan amount, interest rate, and repayment schedule.

The property being financed acts as collateral, providing security to the lender. If the business fails to meet the agreed-upon repayment terms, the lender may have the right to take possession of the property through a legal process.

Business mortgages are common for companies looking to acquire or expand their physical assets. They provide a means for businesses to access the capital needed for real estate investments without paying the full amount upfront.

This financial tool allows companies to manage their cash flow while securing the necessary space for their operations.

Is Debt Consolidation a Good Reason to Get a Loan?

How Hard Is It to Get a Debt Consolidation Loan?

Does a Consolidation Loan Hurt Your Credit Score?

how do mortgage work?

A mortgage is a financial arrangement that enables individuals or businesses to purchase real estate without paying the full purchase price upfront.

Here’s a simplified explanation of how a mortgage works:

- Loan Application:

- Borrowers apply for a mortgage from a lender (typically a bank or mortgage company). The application involves providing financial information, credit history, and details about the property to be purchased.

- Loan Approval:

- The lender reviews the borrower’s financial information, creditworthiness, and the property’s value. If approved, the lender offers a loan amount, interest rate, and terms.

- Down Payment:

- The borrower makes a down payment, which is a percentage of the property’s purchase price. The remaining amount is the loan amount that will be financed.

- Property Appraisal:

- The lender may conduct an appraisal to assess the property’s value. This helps determine if the property is worth the purchase price and if it serves as adequate collateral for the loan.

- Loan Terms:

- Borrowers agree to the terms of the loan, including the interest rate, loan duration (term), and the structure of payments (e.g., fixed-rate or adjustable-rate).

- Closing:

- The closing, or settlement, is the final step. Both parties sign the necessary documents, and the borrower pays closing costs. The lender disburses the loan funds to the seller, and the borrower officially becomes the property owner.

- Repayment:

- Borrowers repay the loan through monthly mortgage payments, which include both principal (the loan amount) and interest. Payments are typically made for the duration of the loan term.

- Interest and Principal:

- In the early years, a larger portion of the monthly payment goes toward interest, and a smaller portion goes toward paying down the principal. Over time, this ratio shifts, and more goes toward the principal.

- Property Ownership:

- While the loan is being repaid, the borrower owns and occupies the property. However, the lender has a security interest in the property until the loan is fully paid.

- Loan Completion:

- Once the borrower repays the loan in full, the mortgage is considered satisfied, and the lender releases any claim on the property.

Mortgage Example

You want to buy a house that costs $200,000. You have saved $40,000 for a down payment, and you plan to take out a mortgage for the remaining $160,000.

Loan Details:

- Loan Amount: $160,000

- Interest Rate: 4% per year

- Loan Term: 30 years

Calculation:

- Down Payment:

- You pay $40,000 upfront as a down payment.

- Loan Amount:

- The remaining amount you borrow from the bank is $160,000.

- Monthly Payments:

- Using a mortgage calculator, you find that your monthly payment for a $160,000 loan with a 4% interest rate over 30 years is approximately $763.

- Total Interest:

- Over the 30-year period, you will pay about $115,838 in interest in addition to the $160,000 principal amount.

- Total Cost of the House:

- The total amount you will have paid by the end of the loan term is $275,838 ($160,000 principal + $115,838 interest).

You successfully bought the house by making a $40,000 down payment and taking out a $160,000 mortgage. Each month, you pay $763 to the bank for 30 years.

By the end of the loan term, you’ve paid back the $160,000 you borrowed, plus $115,838 in interest. The total cost of your $200,000 house, including the down payment and interest paid, is $275,838.

Types of Mortgage Loans

There are several types of mortgages loans designed to suit different financial situations and preferences. Here are some common types:

Why use mortgage Calculator?

A mortgage calculator is like a handy tool that can help you figure out important things when you want to buy a home.

It lets you estimate how much money you might need to pay each month for your home loan.

You can play around with different numbers, like the loan amount, interest rate, and how long you’ll be paying, to see how they affect your monthly payments.

This helps you understand if a home is within your budget. It’s like a quick and easy way to plan and see if you can comfortably afford a home without getting stressed about money.

frequently asked questions

What is a down payment?

A down payment is an initial upfront payment made by the homebuyer, typically a percentage of the property’s purchase price. It is paid at the time of closing.

What is an interest rate?

The interest rate is the cost of borrowing money, expressed as a percentage. It determines the amount of interest the borrower pays on the loan.

What is the loan term?

The loan term is the duration over which the borrower agrees to repay the mortgage. Common terms are 15, 20, or 30 years.

What is a fixed-rate mortgage?

In a fixed-rate mortgage, the interest rate remains constant throughout the loan term, providing predictability in monthly payments.

What is an adjustable-rate mortgage (ARM)?

An adjustable-rate mortgage has an interest rate that may change periodically, usually after an initial fixed period. Monthly payments can fluctuate.

What is PMI?

PMI (Private Mortgage Insurance) is typically required when the down payment is less than 20%. It protects the lender in case of borrower default.

Can I pay off my mortgage early?

Most mortgages allow for early repayment, but it’s essential to check for any prepayment penalties or fees.

What is a home equity loan?

A home equity loan allows homeowners to borrow against the equity in their home, often used for major expenses like home improvements.

What happens if I miss a mortgage payment?

Missing a mortgage payment can result in late fees and negatively impact credit. Communicate with the lender to discuss options and avoid foreclosure.

Can I refinance my mortgage?

Yes, refinancing involves obtaining a new mortgage with different terms, often to secure a lower interest rate or change the loan duration.