The American Express Gold Card is a premium credit card offered by American Express. It is known for its exclusive benefits and rewards tailored for travelers and individuals who dine out frequently.

Cardholders earn Membership Rewards Points for every dollar spent on eligible purchases. These points can be redeemed for various rewards, including travel, gift cards, and merchandise.

The card often offers statement credits for dining at select restaurants and for eligible travel expenses, which can help offset the annual fee.

Cardholders may enjoy travel perks such as access to airport lounges, travel insurance, and other travel-related benefits.

Is American Express Gold Card hard to get?

The eligibility criteria for the American Express Gold Card typically include having a good credit history, a minimum annual income, and meeting other financial requirements.

While it may not be the easiest card to qualify for, it’s not exceptionally difficult to get if you have a good credit score and meet the income requirements. The exact eligibility criteria may vary by region and over time.

Who is eligible for American Express Gold Card?

To be eligible for the American Express Gold Card, you generally need to meet the following criteria:

- Be at least 18 years of age.

- Have a minimum annual income, which can vary by region.

- Have a good credit history with no recent defaults or late payments.

- Meet any additional criteria specified by American Express in your region.

Is American Express Gold Card a good card?

Whether the American Express Gold Card is a good card for you depends on your spending habits and financial goals. This card is known for offering rewards and benefits in categories like dining, travel, and shopping.

If you frequently spend in these areas, the card can provide excellent value through Membership Rewards points, which can be redeemed for various rewards.

However, it’s essential to evaluate the card’s annual fee and terms to determine if it aligns with your financial needs and preferences.

What does an American Express Gold Card do?

The American Express Gold Card is a credit card that offers several features and benefits, including:

- Membership Rewards points for eligible spending, which can be redeemed for travel, merchandise, gift cards, and more.

- Bonus points for meeting specific spending criteria.

- Travel benefits, such as hotel credits, room upgrades (if available), and access to the Hotel Collection program.

- Dining benefits, including discounts at selected restaurants.

- No pre-set spending limit, providing flexibility in spending.

- Access to exclusive events and experiences.

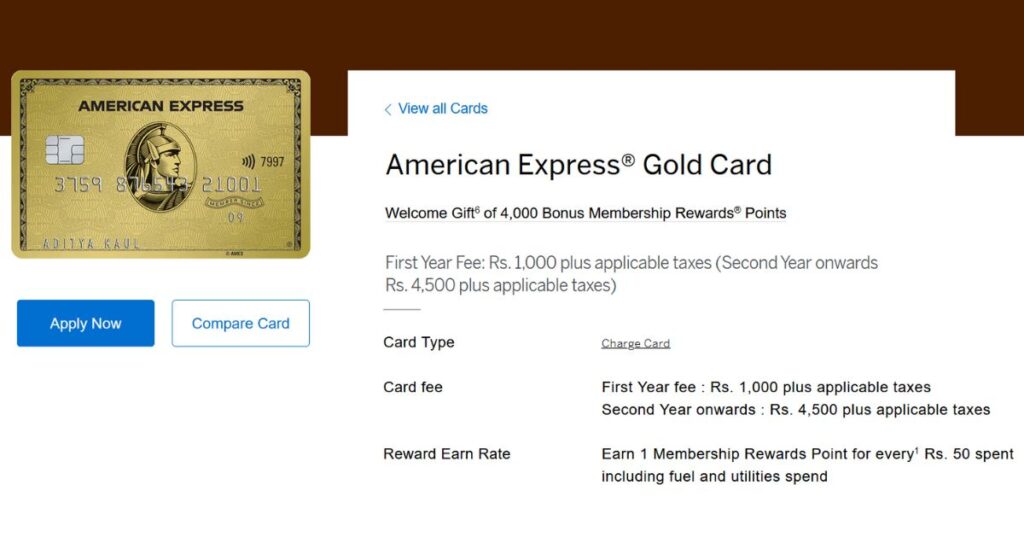

American Express Gold Card:

- Get 1,000 bonus points for making six transactions totaling Rs.1,000 each in a given month.

- Earn 1 Membership Rewards® point for every rupee spent with the Amex Gold Card, including on fuel and utilities.

- Use your Membership Reward Points to purchase items from the exclusive 18 and 24 Karat Gold Collection.

The card may offer bonus points for spending in specific categories, such as dining or airfare.

Bonus Points:

- Earn 1,000 Membership Reward Points every month by making 6 transactions of Rs.1,000 or more each month.

- Receive a welcome gift of 5,000 Membership Reward Points when you pay the card membership fee for the first year. This is credited to your account within 90 days of payment processing. To qualify, you must pay the annual fee in the first year and spend Rs.2,000 within 60 days from the card approval date.

Rewards Points:

- Earn 1 Membership Reward Point for every Rs.50 spent on eligible retail transactions.

- Note that fuel, utility, insurance, and cash transactions do not earn any Membership Reward Points.

Travel Benefits:

- Enjoy a room upgrade (if available) and a USD 100 hotel credit when you stay for two consecutive nights at over 400 hotels worldwide, including Hilton Hotels, Hyatt Hotels, and Intercontinental.

Dining Benefits:

- Avail up to 20% off at selected restaurants.

Credit Card Limit of American Express Gold Card:

- The American Express Gold Card doesn’t come with a pre-set spending limit, providing you with financial flexibility. However, inform Amex in advance if you plan to make a large purchase.

Reward Points Benefits of American Express Gold Card:

- Earn Membership Reward Points starting with a welcome bonus of 5,000 points and an opportunity to earn 1,000 points every month.

- Get an extra point for every Rs.100 spent on eligible transactions made via Amex’s dedicated travel portal.

| Discover More |

| List of Best Credit Cards Available: How to Choose the Right One? |

| List of Best Travel Credit Card for People Who Love to Travel |

How to Redeem Your Points?

- Redeem your accrued points for various products and services, including items from Amex’s 18 Karat and 24 Karat Gold Collection.

Many American Express Gold Cards have no foreign transaction fees, making it a suitable choice for international travelers.

American Express is known for its exceptional customer service, and Gold Cardholders typically have access to 24/7 customer support.

Cardholders may receive exclusive offers, discounts, and access to special events.

The card typically comes with an annual fee, which can vary depending on the specific version of the American Express Gold Card.

American Express Gold Card eligibility

To be eligible for the American Express Gold Card, you should:

- Be at least 18 years old.

- Have an annual income of more than ₹6 lakhs.

- Maintain a good CIBIL score with no past payment defaults.

- If self-employed, your company should be trading for more than 12 months.

How to Apply for American Express Gold Card?

To apply for the American Express Gold Card, follow these steps:

- Visit the American Express Gold Card page.

- Scroll down to the “Apply Now” section and click on “Apply.”

- Fill in the credit card application form with your personal details.

- After clicking “Save and Continue,” provide your financial and additional information.

- Submit the form for review. The bank will verify your details and approve or reject your application.

- You can track your AMEX credit card application status online or contact AMEX customer care for queries.

Documents Required for Credit Card Application

When applying for a credit card, you will need to provide:

- KYC documents (PAN card, address proof, and ID proof).

- Income proof, such as salary slips or Form 16.

- Passport-size colored photographs.

| American Express Gold Card | Fees & Charges |

|---|---|

| Joining Fee | Rs.1,000 + taxes |

| Annual Fee | Rs.4,500 + taxes |

| Cash Advance Fee | 3.5% per transaction or Rs.250, whichever is higher |

| Add-on Card Fee | Up to two Supplementary Cards provided without charge; each additional Supplementary Card costs Rs.1,500 |

Hey, I’m Ratiranjan Singha, the Creator of Myworldstuffs.com. I Offer in-Depth Articles and Guides that Help you to Understand Various Financial Concepts.