First Premier Bank is a South Dakota-based institution specializing in credit cards for individuals with limited credit history.

Their cards, like the FPB CR Card, are designed for credit-building or rebuilding, particularly for those with imperfect credit. Such cards often come with higher fees and interest rates, aiming to mitigate risk.

It’s vital for users to manage them responsibly to avoid debt accumulation. For the latest details on First Premier Bank’s offerings, including the FPB CR Card, it’s recommended to visit their official site or contact their customer service. Keep in mind that terms and conditions may change.

First Premier Bank Facts

- First Premier Bank is headquartered in Sioux Falls, South Dakota, USA. It specializes in offering credit cards primarily to individuals with limited credit history or poor credit scores.

- The bank’s credit cards, including the FPB CR Card, are designed to help users establish or rebuild their credit profiles. These cards can serve as tools to demonstrate responsible credit behavior over time.

- First Premier Bank’s credit cards are often classified as subprime credit cards. They typically come with lower credit limits, higher interest rates, and additional fees compared to traditional credit cards.

- Many of First Premier Bank’s cards may have application fees, annual fees, and processing fees. These fees can impact the overall cost of using the card and should be carefully considered.

- The bank’s target demographic includes individuals who might have difficulty obtaining credit from other sources due to their credit history. These cards cater to a market segment seeking to rebuild their creditworthiness.

- Users are advised to use these cards responsibly by making timely payments and keeping their credit utilization low. Such practices can contribute to improving credit scores over time.

- For the latest information about First Premier Bank’s offerings, including the FPB CR Card, individuals should refer to the official bank website or directly contact their customer service, as terms, conditions, and offerings can change.

- Using these cards to exhibit sound credit management can positively impact credit scores, but accruing high balances or missing payments could worsen credit standings.

- While First Premier Bank’s cards can be helpful for credit building, individuals should also explore secured credit card options and other credit-building strategies that might offer more favorable terms.

- The financial industry evolves, and products may change. It’s important for individuals to stay informed about the latest credit-building opportunities and financial solutions available to them.

What Is FPB CR Card?

FPB CR Card is a credit card product offered by First Premier Bank, a financial institution headquartered in Sioux Falls, South Dakota. The FPB CR Card is designed for consumers with poor or limited credit history who are looking to improve their credit scores.

The FPB CR Card is a secured credit card, which means that customers are required to make a security deposit in order to open the account. The amount of the security deposit typically determines the customer’s credit limit.

By using the FPB CR Card responsibly and making payments on time, customers can build their credit scores over time.

The FPB CR Card offers several benefits to customers, including online account access, fraud liability protection, and monthly reporting to the major credit bureaus. The card also has a competitive annual percentage rate (APR) and no penalty APR.

Overall, the FPB CR Card is a valuable tool for consumers who are looking to improve their credit scores and build a strong credit history.

However, it is important for customers to use the card responsibly and make payments on time in order to avoid late fees and negative impacts to their credit scores.

What Is First Premier Bank?

First Premier Bank is a financial institution headquartered in Sioux Falls, South Dakota. It was founded in 1986, and it is currently one of the largest issuers of Mastercard credit cards in the United States.

First Premier Bank has been serving customers for over 35 years, and it offers a range of banking products and services.

In this article, we will provide a comprehensive guide to First Premier Bank, including its history, products and services, and benefits.

History of First Premier Bank

First Premier Bank was founded in 1986 by T. Denny Sanford, a businessman from South Dakota. The bank began as a small community bank, but it has since grown into a major financial institution with over $2 billion in assets.

First Premier Bank is known for its credit card products, which are marketed to consumers with poor or limited credit history. In recent years, the bank has also expanded its offerings to include personal loans, auto loans, and savings accounts.

Products and Services

First Premier Bank offers a variety of financial products and services to meet the needs of its customers. Some of the products and services offered by the bank include:

Credit Cards: First Premier Bank is known for its credit card products, which are designed for consumers with poor or limited credit history. The bank offers several credit card options, including secured credit cards, unsecured credit cards, and credit cards for businesses.

Personal Loans: First Premier Bank offers personal loans with competitive interest rates and flexible repayment terms. Customers can use these loans for a variety of purposes, including debt consolidation, home repairs, and unexpected expenses.

Auto Loans: First Premier Bank offers auto loans with competitive interest rates and flexible repayment terms. Customers can use these loans to purchase new or used vehicles, or to refinance existing auto loans.

Savings Accounts: First Premier Bank offers a variety of savings accounts, including traditional savings accounts, money market accounts, and certificates of deposit (CDs). These accounts offer competitive interest rates and are FDIC insured.

Benefits of Banking with First Premier Bank

There are several benefits to banking with First Premier Bank. These benefits include:

Credit Building: First Premier Bank’s credit card products are designed to help consumers with poor or limited credit history build their credit scores. By using these credit cards responsibly and making payments on time, customers can improve their credit scores over time.

Flexible Repayment Terms: First Premier Bank offers flexible repayment terms on its personal and auto loans. This allows customers to choose a repayment schedule that works for their budget and financial goals.

Competitive Interest Rates: First Premier Bank offers competitive interest rates on its credit cards, personal loans, and auto loans. This allows customers to borrow money at an affordable rate and save money on interest charges.

FDIC Insurance: First Premier Bank is FDIC insured, which means that customers’ deposits are insured up to $250,000 per depositor. This provides peace of mind and protection for customers’ savings.

What does it mean to help?

The FPB is also an association of private companies. Typically, FPB CR card on bank statement contains the transaction as well as the PN number of the company that processed the transaction. Call this number. If not, ask your husband.

He doesn’t trust you. even though he now knows you’ve checked your bank account.So you know, you know is it business? Do you have any reason to spy on people who work for you?

You’ll want to see if your employees are doing something different from what they should be doing. don’t know why you should, so keep the evidence in a clear place like your account.

What is an FPB credit card?

An FPB credit card refers to any of the credit card products offered by First Premier Bank, a financial institution based in Sioux Falls, South Dakota.

First Premier Bank is known for offering credit cards to consumers with poor or limited credit history, as well as those who may have difficulty obtaining credit elsewhere.

The FPB credit card product line includes both secured and unsecured credit cards, as well as credit cards for businesses. The secured credit cards require a refundable security deposit that is used as collateral to secure the credit line, while unsecured credit cards do not require a deposit.

FPB credit cards typically come with higher interest rates and fees compared to other credit cards, as they are designed for customers who may pose a higher risk to lenders.

The benefits and features of FPB credit cards vary depending on the specific product, but may include rewards programs, online account management, zero fraud liability protection, and monthly reporting to credit bureaus to help customers build their credit scores.

Overall, FPB credit cards can be a useful financial tool for individuals who are looking to build or rebuild their credit history.

However, it’s important for customers to understand the terms and conditions of their FPB credit card, including the fees, interest rates, and payment due dates, and to use their card responsibly in order to avoid potential negative impacts to their credit scores.

First Premier card credit limit

The credit limit on a First Premier Bank credit card can vary depending on several factors, including the specific credit card product, the customer’s creditworthiness, and the amount of the security deposit (for secured credit cards).

For the FPB CR Card, which is a secured credit card, the credit limit is typically equal to the amount of the security deposit that the customer puts down to open the account.

The minimum security deposit required for the FPB CR Card is $200, and the maximum credit limit is $5,000.

For unsecured FPB credit cards, the credit limit is determined by the bank based on the customer’s creditworthiness and other factors.

The credit limit on an unsecured FPB credit card may start out lower than on other credit cards, but may be increased over time if the customer makes payments on time and demonstrates responsible credit behavior.

It’s important to note that using a high percentage of your available credit limit can negatively impact your credit score, so it’s generally recommended to keep your credit utilization ratio (the amount of credit you’re using compared to your credit limit) below 30%.

Additionally, it’s important to make payments on time and to avoid carrying a high balance, as high interest rates and fees can add up quickly and make it difficult to pay off the debt.

Is First Premier Bank Platinum Mastercard good?

The First Premier Bank Platinum Mastercard is a credit card that is designed for consumers with poor or limited credit history.

While the card can be a useful tool for building credit, it’s important to understand that it comes with higher fees and interest rates than many other credit cards on the market.

One advantage of the First Premier Bank Platinum Mastercard is that it reports to all three major credit bureaus each month.

This means that if you use the card responsibly and make payments on time, you can improve your credit score over time.

Additionally, the card comes with Mastercard benefits such as zero liability for unauthorized purchases and travel accident insurance.

However, it’s important to be aware of the fees associated with the First Premier Bank Platinum Mastercard. The card has an annual fee that can range from $75 to $125 for the first year, and then drops to $45 to $49 in subsequent years.

There is also a one-time program fee of up to $95 when you open the account, as well as monthly maintenance fees that can range from $6.25 to $10.40 per month.

Furthermore, the card has a high APR that can reach up to 36%, making it important to pay off your balance in full each month to avoid accruing interest charges. The credit limit on the card may also be low to start, which can limit your purchasing power.

Overall, the First Premier Bank Platinum Mastercard can be a good option for building credit, but it’s important to be aware of the fees and interest rates associated with the card and to use it responsibly to avoid potential negative impacts on your credit score and finances.

First premier bank login

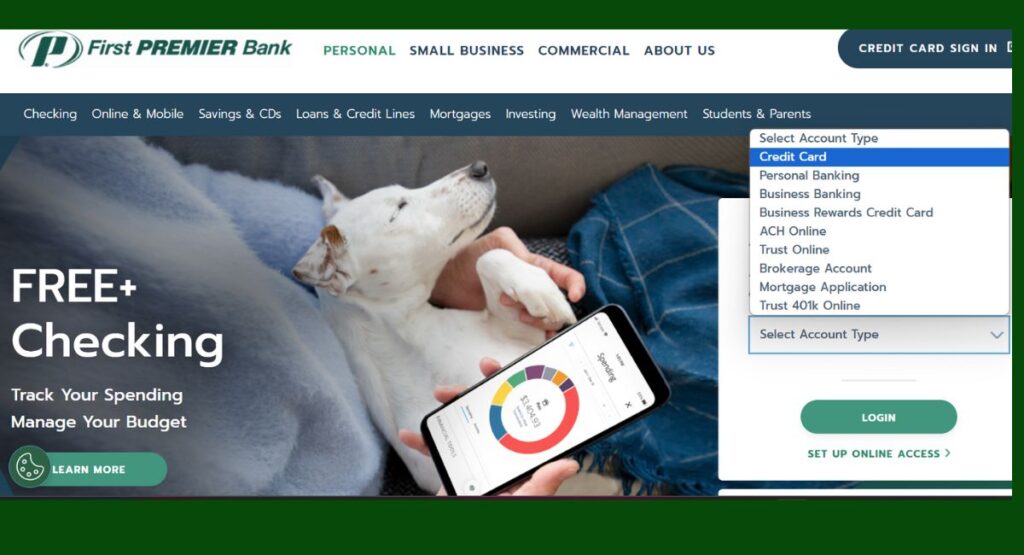

Log in to your First Premier Bank account, follow these general steps:

- Open your web browser and go to the official First Premier Bank website. Ensure that you are using the correct and secure website address.

- On the homepage, you should see a section for logging in. This is typically located at the top of the page or prominently displayed.

- In the login section, you’ll need to provide your username and password. If you haven’t registered for online banking, you might need to sign up first.

- Some online banking systems might require additional security measures, such as entering a verification code sent to your registered email or phone.

- Once you’ve entered the required information and completed any security checks, you should be able to access your First Premier Bank account. You’ll likely have access to account balances, transactions, statements, and other banking services.

Hey, I’m Ratiranjan Singha, the Creator of Myworldstuffs.com. I Offer in-Depth Articles and Guides that Help you to Understand Various Financial Concepts.