A home equity loan is when you borrow money using the value of your home as collateral. Imagine your home is like a piggy bank.

Over time, as you pay your mortgage, the value of your home goes up. With a home equity loan, you can ask the bank to give you some of that money back.

It’s like taking a loan with your home as a guarantee. You get a lump sum of cash, and then you pay it back over time with interest.

People often use home equity loans for big expenses like home improvements, education, or medical bills.

how does a home equity loan work?

A home equity loan works by letting you borrow money based on the value of your home. After you apply and get approved, the lender gives you a lump sum of cash, which you pay back over time with fixed monthly payments.

The amount you can borrow depends on how much equity you have in your home. People often use these loans for things like home improvements or paying off debts. If you can’t pay it back, the lender might take your home.

Benefits

Home equity loans have some good things about them. First, they let you get a chunk of money to use for things like fixing your home or paying off debts.

The interest rates are often lower than what you’d get with credit cards or personal loans, making them a cheaper way to borrow.

Sometimes, the interest you pay on a home equity loan might even be tax-deductible, but it’s smart to check with a tax pro. Plus, you get to pay back the loan with fixed monthly payments, making it easier to plan your budget.

Is Debt Consolidation a Good Reason to Get a Loan?

How Hard Is It to Get a Debt Consolidation Loan?

Does a Consolidation Loan Hurt Your Credit Score?

home equity loan rates

| TYPE | AVERAGE RATE | AVERAGE RATE RANGE |

|---|---|---|

| Home equity loan | 8.98% | 8.60% – 10.12% |

| 10-year fixed home equity loan | 9.08% | 7.79% – 10.00% |

| 15-year fixed home equity loan | 9.08% | 7.70% – 10.86% |

Home Equity Loan requirements

- Sufficient Equity:

- Lenders usually require a minimum amount of equity in your home, often around 15% to 20%. Equity is the difference between your home’s value and your mortgage balance.

- Good Credit Score:

- A solid credit score is generally necessary for approval. While requirements vary, a score of 620 or higher is often sought by lenders for favorable terms.

- Steady Income:

- Lenders assess your ability to repay, so a consistent income is crucial. Employment stability and a low debt-to-income ratio may also be considered.

- Loan-to-Value Ratio (LTV):

- The LTV ratio, calculated by dividing the loan amount by the appraised value of your home, is an important factor. Lenders often have maximum LTV ratios, such as 80%.

- Property Appraisal:

- A professional appraisal of your home’s value is typically required to determine the amount of equity available for borrowing.

- Debt-to-Income Ratio:

- Lenders assess your debt-to-income ratio to ensure you can manage additional debt. This ratio compares your monthly debt payments to your gross income.

- Documentation:

- You’ll need to provide various documents, including proof of identity, income verification (pay stubs or tax returns), and details about your property.

- Insurance:

- Lenders may require homeowners insurance to protect their interest in the property. Flood insurance might be necessary if you live in a flood-prone area.

- Credit History:

- A history of responsible credit usage is generally favorable. Lenders will review your credit report to assess your financial behavior.

- Occupancy:

- Some lenders may require that the home used for the loan is your primary residence, not an investment property.

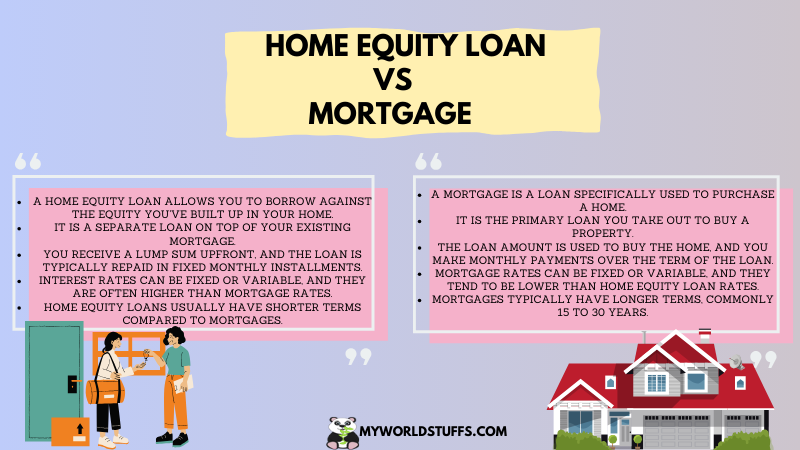

home equity loan Alternatives

Alternatives to a home equity loan include personal loans, which are unsecured and don’t require collateral. Another option is a home equity line of credit (HELOC), allowing you to borrow against your home’s equity as needed.

Refinancing your mortgage is also a choice, where you replace your existing mortgage with a new one.

home equity loan calculator

A home equity loan calculator is like a helpful tool for homeowners. It lets them guess how much money they might be able to borrow and figure out how much they would need to pay each month.

You just put in details like your home’s value, how much is left on your mortgage, and the interest rate.

The calculator then gives you an idea of the loan amount and monthly payments. It’s handy because you can try different scenarios, see how changing the loan amount or time affects payments, and compare different loan offers. You Can use our Mortgage Calculator too.

frequently asked questions

What is a home equity loan?

A home equity loan is a type of loan where you can borrow money using the equity in your home as collateral. Equity is the difference between your home’s value and the remaining balance on your mortgage.

How do I qualify for a home equity loan?

To qualify for a home equity loan, you typically need a good credit score, sufficient home equity, and a steady income. Lenders will also consider factors like your debt-to-income ratio.

How much money can I borrow with a home equity loan?

The amount you can borrow depends on your home’s appraised value, your mortgage balance, and the lender’s loan-to-value ratio. Usually, you can borrow a percentage of your home’s equity.

How does repayment work?

Repayment involves making fixed monthly payments over a set term. The terms include the interest rate, repayment period, and any associated fees. It’s crucial to understand these terms before committing to a loan.

Are home equity loan interest rates fixed or variable?

Home equity loans can have either fixed or variable interest rates. Fixed rates stay the same throughout the loan term, while variable rates can change, affecting your monthly payments.

How long does it take to get a home equity loan?

The time to get a home equity loan varies, but it often takes a few weeks. The process involves application, appraisal, and approval stages.

Quick Links

These Interest rates are subject to change. It is advisable to check the latest rates below before applying for a Home loan with a particular lender or banks.

Others

United States

Disclaimer

Display of any trademarks, tradenames, logos and other subject matters of intellectual property belong to their respective intellectual property owners. Display of such IP along with the related product information does not imply Myworldstuffs partnership with the owner of the Intellectual Property or issuer/manufacturer of such products.