Mastercard, a global leader in the payments industry, is an iconic brand that has played a pivotal role in transforming the way people transact and access financial services.

Established in 1966 as “Master Charge: The Interbank Card,” and later rebranded as Mastercard in 1979, this multinational financial services corporation has continuously evolved to meet the ever-changing needs of consumers and businesses worldwide.

But why does Mastercard need to exist, and what role does it play in the modern world? Let’s Find Out!!

How to Identify a Mastercard Credit Card?

A Mastercard credit card is a widely recognized and widely accepted payment card that allows cardholders to make purchases on credit, providing a convenient and flexible way to manage finances.

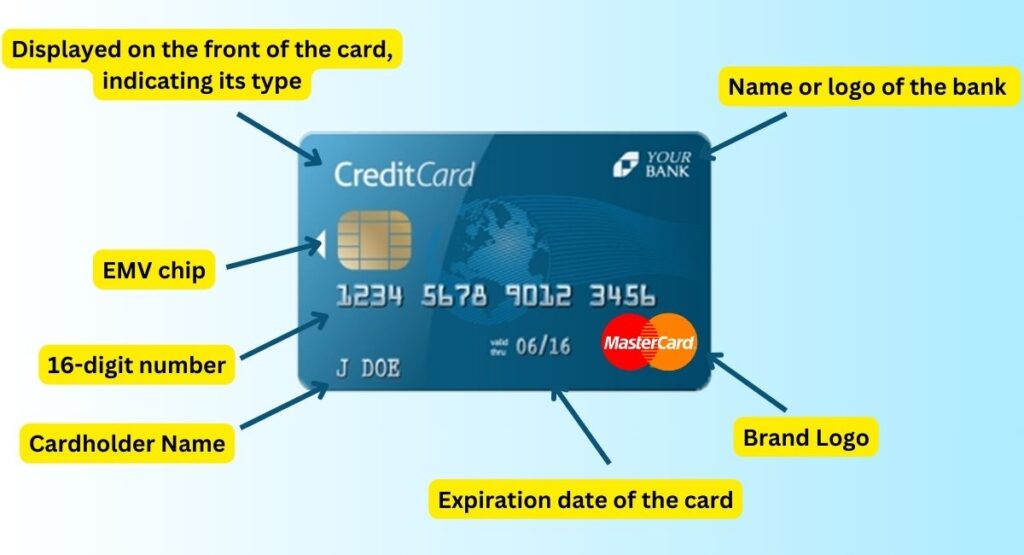

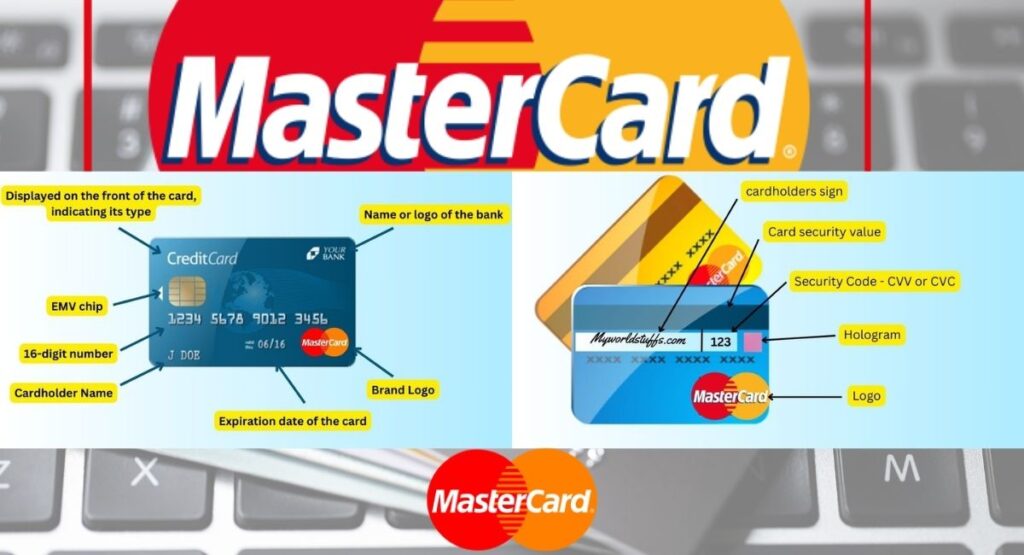

- Mastercard Logo: The most obvious indicator is the Mastercard logo, which typically appears on the front of the card. It consists of two overlapping circles with the word “Mastercard” written in the center.

- Card Type: Mastercard credit cards often have the words “Credit Card” or “Credit” prominently displayed on the front of the card, indicating its type.

- Card Number: The card number on the front of the card is typically a 16-digit number, which is a common format for credit cards.

- EMV Chip: Most Mastercard credit cards are equipped with an EMV chip, which is a small metallic square on the front of the card. This chip enhances security by generating a unique transaction code for each purchase.

- Cardholder Name: The cardholder’s name is usually printed on the front of the card.

- Expiration Date: Look for the expiration date of the card, which is also printed on the front.

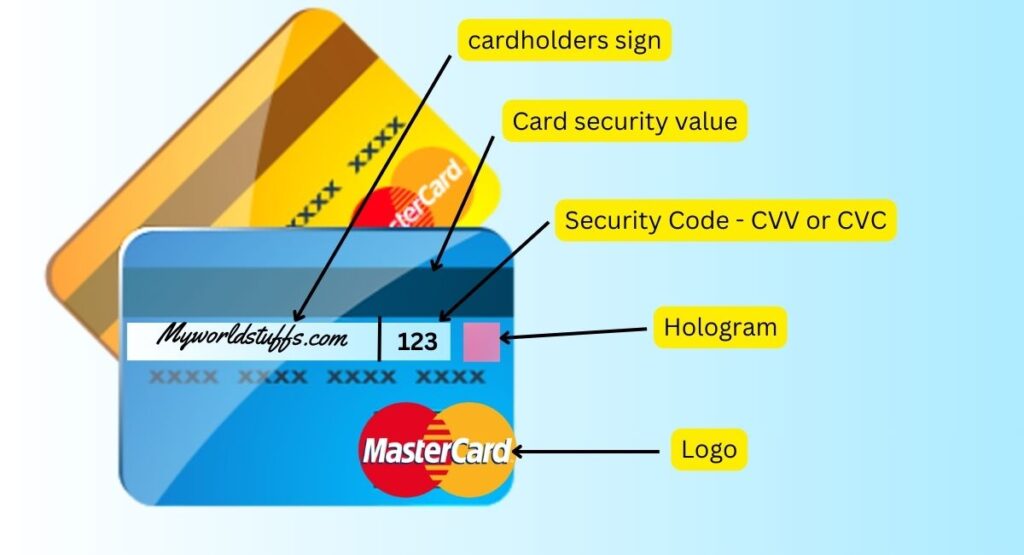

- Security Features: Mastercard credit cards often have security features like holograms, a signature panel on the back, and sometimes additional security elements to protect against counterfeiting.

- Issuer’s Logo: The name or logo of the bank or financial institution that issued the Mastercard credit card is usually displayed on the front or back of the card.

- Signature Strip: On the back of the card, there is typically a white strip where cardholders can sign their names for added security.

- CVV or CVC: The Card Verification Value (CVV) or Card Verification Code (CVC) is a three-digit number printed on the back of the card (four digits on the front for some cards). It’s used for online and phone transactions to verify that you possess the physical card.

These cards are issued by various financial institutions and are linked to a credit line, enabling users to borrow money up to a predetermined credit limit. Mastercard credit cards are versatile, allowing purchases at millions of locations worldwide, both in-person and online.

They often come with features such as rewards programs, cashback incentives, and travel benefits.

Cardholders can choose to pay off their balances in full each month or make minimum payments, with interest accruing on any outstanding balances.

Mastercard’s global presence and commitment to security make its credit cards a trusted choice for consumers seeking a secure and convenient payment method.

How to Apply a Mastercard Credit Card?

Mastercard credit cards and payment services are not provided directly by Mastercard itself.

Instead, Mastercard operates as a global payment network and technology company that partners with various financial institutions, including banks and credit unions, to issue Mastercard-branded credit, debit, and prepaid cards.

These financial institutions are commonly referred to as “issuing banks” or “issuers.”

When you apply for a Mastercard credit card, you do so through a specific financial institution that offers Mastercard products. The issuing bank evaluates your creditworthiness and extends a line of credit to you if approved.

They will also set the terms and conditions of the credit card, including the interest rates, fees, and any rewards or benefits associated with the card.

There are different types of Mastercard, each catering to different needs and financial situations, including standard credit cards, premium or rewards cards, and prepaid cards.

The specific terms and features of a Mastercard credit card can vary from one issuing bank to another, so it’s advisable to review and compare the offers from different financial institutions to find the one that best suits your requirements.

| Best Credit Cards |

| List of Best Credit Cards Available: How to Choose the Right One? |

| Select List of Best Travel Credit Card for People Who Love to Travel |

Best MasterCard Credit Card Providers in India Banks

Indian banks have forged strong partnerships with global payment networks like Mastercard to provide their customers with a wide range of credit and debit card options.

These collaborations have significantly enhanced the convenience, security, and accessibility of financial transactions in India.

| Indian Banks | Mastercard Card Types Offered |

|---|---|

| State Bank of India (SBI) | Mastercard credit and debit cards including Platinum, Gold, and Silver variants. |

| ICICI Bank | Mastercard credit and debit cards, including Coral, Platinum, and Signature variants. |

| HDFC Bank | Mastercard credit and debit cards, including Regalia, Regalia First, and Platinum variants. |

| Axis Bank | Mastercard credit and debit cards, including Neo, Magnus, and Burgundy variants. |

| Punjab National Bank (PNB) | Mastercard credit and debit cards, including Gold and Classic variants. |

| Bank of Baroda | Mastercard credit and debit cards, including Platinum and Gold variants. |

| Kotak Mahindra Bank | Mastercard credit and debit cards, including Royale Signature, Privy League, and Gold variants. |

| IDFC FIRST Bank | Mastercard credit and debit cards, including First Classic, First Millennia, and EMI variants. |

| YES Bank | Mastercard credit and debit cards, including Prosperity, Preferred, and Titanium variants. |

| IndusInd Bank | Mastercard credit and debit cards, including Iconia, Platinum, and Classic variants. |

| Federal Bank | Mastercard credit and debit cards, including Platinum and Gold variants. |

Mastercard, being one of the world’s leading payment technology companies, has empowered Indian banks to offer various Mastercard-branded cards tailored to the diverse needs and preferences of consumers.

These cards not only enable seamless domestic and international transactions but also come with a host of benefits, such as cashback rewards, travel perks, and enhanced security features like EMV chip technology and two-factor authentication.

The partnership between Indian banks and Mastercard has played a crucial role in driving the country’s digital payment ecosystem.

With the rise of digital wallets and online payments, Mastercard’s technology and infrastructure have supported the transition to a cashless society, making it easier for Indians to make secure and convenient electronic payments.

Best MasterCard Credit Card Providers Global Banks

Global banks partner with Mastercard to provide their customers with versatile credit and debit card options.

| Global Banks | Mastercard Card Types Offered |

|---|---|

| JPMorgan Chase & Co. | Mastercard credit and debit cards, including Sapphire, Freedom, and World Elite variants. |

| Bank of America | Mastercard credit and debit cards, including Cash Rewards, Travel Rewards, and Premium Rewards variants. |

| Citibank (Citigroup) | Mastercard credit and debit cards, including Premier, Prestige, and ThankYou variants. |

| Wells Fargo | Mastercard credit and debit cards, including Propel, Cash Wise, and Platinum variants. |

| Barclays | Mastercard credit and debit cards, including Arrival, AAdvantage, and Premier variants. |

| HSBC | Mastercard credit and debit cards, including Premier World Elite, Advance, and Platinum variants. |

| Deutsche Bank | Mastercard credit and debit cards, including Platinum, Gold, and Classic variants. |

| BNP Paribas | Mastercard credit and debit cards, including World Elite, Premier, and Classic variants. |

| Standard Chartered Bank | Mastercard credit and debit cards, including Priority, Manhattan, and Platinum variants. |

| UBS | Mastercard credit and debit cards, including UBS Credit Card and UBS Debit Card. |

| ING Group | Mastercard credit and debit cards, including Orange Credit Card and ING Debit Card. |

| Santander | Mastercard credit and debit cards, including 1 |

| Scotiabank | Mastercard credit and debit cards, including Passport, Gold, and Momentum variants. |

These collaborations offer consumers access to a wide range of financial products that come with global acceptance, robust security measures, and often include rewards and benefits tailored to their needs.

Mastercard’s widespread network and innovative technology have played a pivotal role in shaping the modern global financial landscape, making transactions more convenient and secure for millions of people worldwide.

What does the Mastercard do?

Mastercard does a bunch of cool stuff! It’s like a magic wand for payments. So, when you use a Mastercard, it lets you buy things without needing cash. You can shop online or in stores, book flights, and even pay for your favorite pizza.

Plus, it’s super safe, thanks to things like chip technology and security measures. So, in a nutshell, Mastercard makes your life easier when it comes to paying for things – it’s like your trusty sidekick in the world of spending!

Mastercard Credit Card Types

| Type of Mastercard Card | Uses | Benefits |

|---|---|---|

| Mastercard Standard | Everyday purchases, online shopping, travel | Widely accepted globally, basic protection against fraud, often no annual fee. |

| Mastercard Gold | Enhanced rewards, premium benefits | Higher credit limits, rewards programs, travel insurance, purchase protection, and extended warranty. |

| Mastercard Platinum | Luxury travel, exclusive perks | Access to airport lounges, concierge services, premium travel insurance, generous rewards programs. |

| Mastercard World Elite | Luxury travel, premium experiences | Exclusive travel and lifestyle perks, priority service, luxury travel benefits, high credit limits. |

| Mastercard Business | Business expenses, managing company finances | Expense tracking, employee card controls, business-specific rewards, reporting tools. |

| Mastercard Debit | Everyday spending, ATM withdrawals | Linked to a bank account, no interest charges, wide acceptance for payments and withdrawals. |

| Mastercard Prepaid | Budgeting, online purchases | Preloaded with funds, no credit check required, control over spending, and no risk of debt. |

| Mastercard Secured | Rebuilding credit, establishing credit | Requires a security deposit, helps build or rebuild credit history. |

mastercard debit card

A Mastercard debit card is your gateway to seamless spending and financial convenience. It’s not your ordinary card; it’s your ticket to a cashless world. With this little piece of plastic (or digital version on your smartphone), you can make purchases at stores, dine out, shop online, and withdraw cash from ATMs.

When you use a Mastercard debit card, you’re not running up a credit bill. It’s directly linked to your bank account. So, you’re spending your own money, making budgeting a breeze. Plus, it’s incredibly secure, thanks to features like EMV chips and PINs.

Mastercard debit cards offer global acceptance. Whether you’re in your hometown or traveling the world, you can count on it being welcomed at millions of locations. It’s like having a universal key to the world of commerce.

Oh, and did I mention rewards? Many Mastercard debit cards come with rewards programs, so you can earn cashback, discounts, or even travel perks as you spend. It’s like getting a little bonus every time you swipe or tap.

So, if you’re looking for a hassle-free, secure, and rewarding way to manage your money and make payments, a Mastercard debit card might just be your perfect companion. It’s the card that empowers you to shop smart and live your life to the fullest, one transaction at a time.

Mastercard Credit Card VS Mastercard Debit Card

| Aspect | Mastercard Credit Card | Mastercard Debit Card |

|---|---|---|

| Payment Source | Borrowed credit with interest charges | Funds from linked bank account |

| Spending Limit | Credit limit set by issuing bank | Limited by available funds in account |

| Billing and Payments | Monthly statement, option to carry balance | Transactions deducted immediately |

| Interest Charges | Accrue if balance carried over | No interest charges |

| Impact on Credit Score | Can positively/negatively affect credit score | Does not impact credit score |

| Overdrafts | Not applicable, limited to credit limit | May allow overdrafts (bank-dependent) |

mastercard Benefits

Mastercard is not just a financial services company; it is a vital pillar of the modern global economy. Its existence is essential because it fosters commerce, ensures payment security, promotes financial inclusion, drives innovation, connects the world, and fuels economic growth.

Facilitating Commerce: Mastercard’s primary mission is to make commerce easier, safer, and more efficient. It acts as a bridge between consumers, merchants, and financial institutions, enabling seamless transactions globally.

With the rise of e-commerce and the digital economy, Mastercard’s presence has become indispensable in connecting buyers and sellers, whether they are located down the street or on different continents.

Payment Security: As digital transactions have become more prevalent, so too have the risks associated with them. Mastercard invests heavily in cutting-edge technologies to enhance payment security.

From EMV chip technology to tokenization and biometrics, Mastercard continually innovates to protect consumers and merchants from fraud and data breaches, ensuring that people can trust the payment ecosystem.

Financial Inclusion: Mastercard recognizes the importance of financial inclusion and aims to provide access to financial services for underserved populations.

Through various initiatives, such as the Mastercard Foundation, the company helps empower people in developing countries by promoting financial literacy, creating digital payment solutions, and supporting small businesses.

This commitment to inclusion reflects a broader societal need for equitable access to financial resources.

Innovation and Technology: The world is witnessing a rapid transformation in payment methods, with trends like contactless payments, mobile wallets, and blockchain gaining momentum.

Mastercard’s existence is crucial in driving these innovations forward. It invests in research and development to create cutting-edge solutions that not only meet the needs of today but also anticipate those of tomorrow.

Global Connectivity: Mastercard operates in over 210 countries and territories, serving as a link between diverse financial systems and currencies.

This global reach facilitates cross-border transactions, making international trade and travel more accessible.

In an increasingly interconnected world, Mastercard’s role in fostering economic growth and cultural exchange is undeniable.

Economic Growth: Mastercard contributes to economic growth by enabling businesses to expand their customer base and access financial tools for growth.

Through its data analytics and insights, it helps governments and companies make informed decisions about consumer behavior and market trends. This data-driven approach fuels innovation and entrepreneurship.

mastercard eligibility

Eligibility for Mastercard may vary depending on the issuing bank and the specific card type. However, here are some common eligibility criteria in bullet points:

- Age: Typically, you must be at least 18 years old to apply for a Mastercard.

- Income: Most Mastercard applications require a minimum income level to demonstrate your ability to repay credit card charges.

- Credit Score: A good credit history and credit score are often necessary for unsecured credit cards.

- Employment Status: You may need to provide proof of employment or a stable source of income.

- Residential Status: You should have a permanent address in the country where you’re applying for the card.

- Identification: You’ll need valid government-issued identification, such as a driver’s license or passport.

- Existing Debts: Banks may consider your existing debt obligations when evaluating your eligibility.

- Bank Account: You may need to have or open a bank account with the issuing institution.

Hey, I’m Ratiranjan Singha, the Creator of Myworldstuffs.com. I Offer in-Depth Articles and Guides that Help you to Understand Various Financial Concepts.