A lines of credit (LOC) is a flexible borrowing arrangement that allows an individual, business, or organization to access funds up to a pre-approved limit.

It operates somewhat like a credit card in terms of flexibility. Instead of receiving a lump sum amount at once, the borrower can draw on the line of credit as needed, up to the established limit.

Interest is typically only charged on the amount borrowed, and once repaid, that portion of the credit line becomes available again.

Lines of credit are commonly used for various purposes, including personal expenses, business operations, or emergencies, providing a revolving and convenient source of funds.

- Credit with flexible access Interest charged only on the borrowed amount Variable or fixed interest rates. Set credit limit based on credit worthiness Minimum monthly payments based on outstanding balance Secured or unsecured options available Renewable credit once repaid Versatile use for various financial needs Impact on credit score based on management

Let’s consider a practical example of a Home Equity Line of Credit (HELOC):

Suppose you own a home valued at $300,000, and you still owe $150,000 on your mortgage. The bank, based on the home’s equity, approves a HELOC with a credit limit of $100,000. This means you can borrow up to $100,000 as needed.

In the first month, you decide to use $20,000 from your HELOC to renovate your kitchen. You start paying interest only on the $20,000 you borrowed. If the interest rate is 5%, you would pay $83.33 in interest for that month (20,000 * 0.05 / 12).

A few months later, you decide to pay back $10,000 of what you borrowed. Now, you only owe $10,000, and the available credit in your HELOC goes back up to $90,000.

Later, you use an additional $30,000 for a home improvement project. Now, you are paying interest on the total borrowed amount of $40,000.

This cycle of borrowing, repaying, and reusing continues within the credit limit. The interest is flexible, based on the outstanding balance.

Is Debt Consolidation a Good Reason to Get a Loan?

How Hard Is It to Get a Debt Consolidation Loan?

Does a Consolidation Loan Hurt Your Credit Score?

Types of Lines of credit

Lines of credit come in various types, catering to different needs and situations:

Personal Line of Credit

A Personal Line of Credit is like a safety net for your finances. It’s a flexible borrowing option that you can use for various personal needs. Imagine it as a pot of money that the bank sets aside for you, but you only take out what you need. You can use it for unexpected expenses, paying bills, or other personal reasons.

The bank approves a maximum amount, and you can borrow up to that limit. You only pay interest on the money you use, and once you repay what you borrowed, the funds become available again, just like a reusable loan.

Home Equity Line of Credit (HELOC)

A Home Equity Line of Credit, or HELOC, is like a special loan that uses the value of your home to give you money when you need it. It’s like having a credit card connected to your home. The bank looks at how much your home is worth and subtracts what you still owe on your mortgage.

Then, they give you a credit limit based on that amount. You can use this money for things like home improvements, education, or other expenses.

The unique part is that you don’t get all the money at once; you can take out what you need, pay it back, and use it again. If you can’t repay, you might risk losing your home, so it’s important to be careful and understand the terms.

Business Line of Credit

A Business Line of Credit is like a financial tool that helps businesses manage their money. It works a bit like a loan that a business can dip into when needed. The bank sets a maximum amount the business can borrow, but the business only takes out what it needs at any given time.

This money can be used to cover various business expenses, like buying inventory, handling cash flow, or dealing with unexpected costs.

The business pays interest on the amount borrowed, and once it pays back what it used, that money becomes available to borrow again. It’s a flexible way for businesses to have extra financial support when necessary without getting a new loan each time.

Demand Line of Credit

A Demand Line of Credit is a bit like a flexible borrowing arrangement that can be helpful for individuals or businesses. It’s different from regular loans because the lender can ask for repayment at any time.

So, it’s like having access to money, but you need to be ready to pay it back when the lender says.

This type of credit gives the lender more control, and borrowers need to be prepared to settle the borrowed amount whenever the lender requests it.

It offers some flexibility, but it’s important to be aware that repayment can be demanded unexpectedly.

What is a line of credit?

A line of credit is a flexible borrowing arrangement where a lender approves a maximum credit limit, and the borrower can access funds as needed, up to that limit.

How does a line of credit work?

Borrowers can draw funds from the line of credit as necessary, repay, and reuse within the approved limit. Interest is typically charged only on the amount borrowed.

How do I qualify for a line of credit?

Qualification depends on factors like creditworthiness, income, and collateral. Lenders assess your ability to repay and manage risk.

Is a line of credit similar to a loan?

Yes, but unlike traditional loans where you receive a lump sum, a line of credit provides ongoing access to funds, and you only pay interest on the borrowed amount.

Can I use a line of credit for any purpose?

Depending on the type of line of credit, you can use it for various purposes, such as home improvements, personal expenses, business operations, or emergencies.

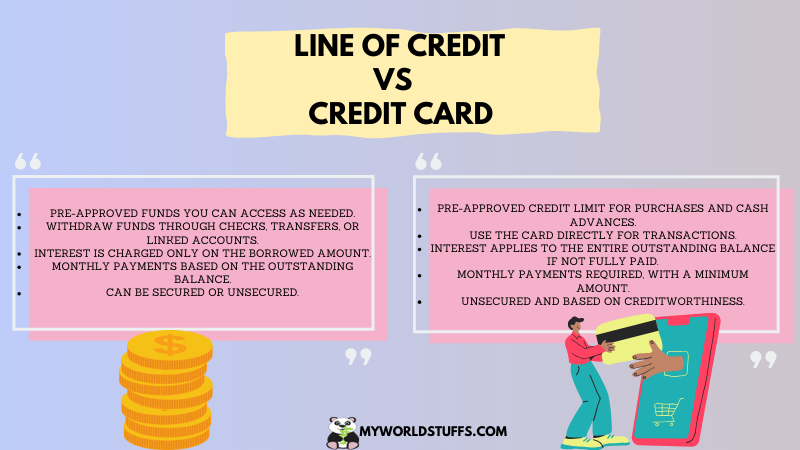

How is a line of credit different from a credit card?

While both offer revolving credit, a line of credit often has lower interest rates, higher limits, and may be secured by collateral. Credit cards are typically unsecured.