As of recent data, a substantial number of people in the UK seek loans for a multitude of purposes.

Statistics indicate that a significant portion of the UK population applies for loans annually, encompassing a wide range of financial needs and aspirations.

Personal loans are frequently sought for various purposes, including debt consolidation, home improvements, financing major purchases such as vehicles or appliances, covering unexpected expenses, and funding special occasions such as weddings or vacations.

Mortgages remain a primary focus for many individuals and families, with aspirations of homeownership driving demand for home loans.

Small businesses often require financing to start or expand their operations, contributing to the demand for business loans.

Education expenses, including tuition fees and living costs, also prompt many individuals to seek student loans.

Car financing is another significant area of borrowing, with many UK residents relying on loans to purchase vehicles.

How to Apply Loan in UK?

In the UK, you can apply for loans through various financial institutions, including:

- Banks: Traditional banks like Barclays, HSBC, Lloyds Bank, and NatWest offer a range of loan products, including personal loans, business loans, and mortgages.

- Credit Unions: Credit unions in the UK, such as London Mutual Credit Union, provide members with access to affordable loans and savings products.

- Online Lenders: Online lending platforms offer quick and convenient loan application processes. Examples include Zopa, Funding Circle, and Ratesetter.

- Peer-to-Peer Lending Platforms: Peer-to-peer lending platforms connect borrowers with individual investors who are willing to fund loans. Examples include Funding Circle and RateSetter.

- Building Societies: Building societies like Nationwide Building Society and Coventry Building Society offer a range of financial products, including savings accounts and mortgages, as well as personal loans.

- Specialist Lenders: Specialist lenders cater to specific needs, such as bad credit loans or loans for self-employed individuals. Examples include Amigo Loans and Bamboo Loans.

- Credit Card Companies: Some credit card issuers offer personal loans to their customers. Examples include Tesco Bank and Sainsbury Bank.

- Payday Lenders: Payday lenders offer short-term loans, but they typically come with high-interest rates and should be used cautiously. Examples include QuickQuid and Wonga.

- Government Programs: The UK government offers various loan programs to support small businesses, students, and homeowners. Examples include the Start Up Loans scheme and the Help to Buy scheme.

When applying for a loan in the UK, it’s essential to compare interest rates, terms, and fees from different lenders to ensure you’re getting the most suitable option for your financial circumstances.

Websites like MoneySuperMarket and Compare the Market allow you to compare loan offers from multiple lenders to find the best deal for your needs.

Barclays Loan

Barclays Loan is a financial service offered by Barclays Bank, one of the leading banks globally.

These loans provide individuals and businesses with access to funds for various purposes, such as purchasing a home, financing a vehicle, covering education expenses, consolidating debt, or investing in a business venture.

Barclays offers a range of loan products tailored to meet different needs and financial situations.

These may include personal loans, which are unsecured loans that do not require collateral, as well as secured loans, where collateral such as property or savings may be required to obtain a lower interest rate or higher loan amount.

Key features of Barclays Loans often include competitive interest rates, flexible repayment terms, and quick approval processes.

Customers may also benefit from online account management tools and personalized support from Barclays’ financial experts throughout the loan application and repayment journey.

HSBC Loan

HSBC Loan is a financial product offered by HSBC, one of the world’s largest banking and financial services organizations.

HSBC provides a variety of loan options tailored to meet the diverse needs of individuals and businesses.

Similar to other financial institutions, HSBC offers both personal and business loans.

Personal loans are typically used for purposes such as home improvements, debt consolidation, or financing a major purchase, while business loans may be utilized for expanding operations, purchasing equipment, or managing cash flow.

HSBC Loans come with various features and benefits designed to suit the unique requirements of borrowers.

These may include competitive interest rates, flexible repayment terms, and the option for secured or unsecured loans depending on the borrower’s preference and financial circumstances.

Lloyds Bank Loan

Lloyds Bank Loan is a financial service provided by Lloyds Banking Group, one of the largest and most established banking institutions in the United Kingdom.

Lloyds Bank offers a range of loan products designed to meet the diverse needs of its customers, whether individuals or businesses.

One of the primary offerings from Lloyds Bank is personal loans, which can be used for various purposes such as home improvements, debt consolidation, purchasing a car, or funding a special event like a wedding or holiday.

These loans typically come with fixed or variable interest rates, flexible repayment terms, and a straightforward application process.

NatWest Loan

NatWest Loan is a financial service provided by NatWest, one of the largest retail and commercial banks in the United Kingdom.

NatWest offers a range of loan products designed to meet the diverse needs of its customers, whether individuals or businesses.

One of the primary offerings from NatWest is personal loans, which can be used for various purposes such as home improvements, debt consolidation, purchasing a car, or funding a special event like a wedding or vacation.

These loans typically come with fixed or variable interest rates, flexible repayment terms, and a straightforward application process.

NatWest also provides secured loans, where borrowers can use assets like their home or savings as collateral, often resulting in lower interest rates and higher loan amounts. This option may be suitable for individuals looking to borrow larger sums of money or those with less-than-perfect credit histories.

For businesses, NatWest offers lending solutions tailored to their specific needs, whether it’s financing growth, purchasing equipment, managing cash flow, or investing in new ventures.

NatWest aims to support businesses of all sizes, from startups to established enterprises, with expert advice and personalized lending options.

Customers applying for a NatWest Loan can expect a user-friendly application process, with online tools available to check eligibility and calculate loan repayments.

NatWest is committed to providing excellent customer service and offers support throughout the loan application and repayment process.

London Mutual Credit Union

London Mutual Credit Union (LMCU) is a financial cooperative serving the residents and communities of London, United Kingdom.

As a credit union, LMCU operates on a not-for-profit basis, owned and controlled by its members, who typically share a common bond such as living or working in the same area.

One of the primary goals of LMCU is to provide accessible and affordable financial services to its members, including savings accounts, loans, and other financial products.

Unlike traditional banks, credit unions like LMCU are focused on serving the needs of their members rather than generating profits for shareholders.

LMCU offers various loan products tailored to the needs of its members, including personal loans, car loans, and home improvement loans.

These loans often come with competitive interest rates, flexible repayment terms, and may be available to members who may not qualify for loans from traditional banks.

Zopa

Zopa loan is a financial product offered by Zopa, one of the pioneering peer-to-peer lending platforms in the United Kingdom.

Zopa operates as an online marketplace connecting individual borrowers with investors willing to lend money.

Zopa loan products cater primarily to individuals seeking personal loans for various purposes, such as debt consolidation, home improvements, car financing, or special events like weddings or vacations.

Through its platform, Zopa facilitates borrowing by matching borrowers with investors who fund their loans.

One of the key features of Zopa loans is competitive interest rates, which are often lower than those offered by traditional banks.

This is made possible by Zopa peer-to-peer lending model, which eliminates the need for intermediaries and reduces overhead costs associated with traditional banking.

Zopa also emphasizes transparency and simplicity in its loan process, with an easy-to-use online platform for loan applications and management.

Borrowers can quickly check their eligibility and receive personalized loan offers based on their creditworthiness and financial situation.

Funding Circle

Funding Circle loan is a financing option provided by Funding Circle, a leading peer-to-peer lending platform specializing in small business loans.

Founded in 2010, Funding Circle has established itself as a key player in the alternative lending industry, connecting small and medium-sized businesses (SME) with investors looking to fund their growth.

Funding Circle loans are tailored to the needs of SMEs across various industries, including retail, hospitality, manufacturing, and services.

These loans can be used for a wide range of purposes, such as expansion, working capital, purchasing equipment, hiring staff, or marketing initiatives.

One of the primary advantages of Funding Circle loans is accessibility. SMEs can apply for loans online through Funding Circle platform, streamlining the application process and reducing the time it takes to secure financing.

This provides businesses with quick access to the funds they need to capitalize on growth opportunities or navigate challenges.

Funding Circle also offers competitive interest rates and flexible repayment terms, allowing businesses to choose loan terms that align with their cash flow and budgetary requirements.

Additionally, Funding Circle does not charge early repayment fees, giving businesses the flexibility to repay their loans ahead of schedule without incurring penalties.

Ratesetter

RateSetter loan is a financial product offered by RateSetter, one of the prominent peer-to-peer lending platforms in the United Kingdom.

RateSetter connects borrowers with investors who are willing to lend money, providing an alternative source of financing outside traditional banking channels.

RateSetter offers a variety of loan products tailored to the needs of individual borrowers and businesses.

These loans can be used for various purposes, such as debt consolidation, home improvements, car financing, or funding special events like weddings or vacations.

One of the key features of RateSetter loans is competitive interest rates, which are often lower than those offered by traditional banks.

This is made possible by RateSetter peer-to-peer lending model, which cuts out intermediaries and reduces overhead costs, resulting in cost savings for borrowers.

Nationwide Building Society

Nationwide Building Society is one of the largest mutual financial institutions in the United Kingdom, providing a wide range of banking and financial services to its members.

Founded in 1846, Nationwide operates as a mutual organization, owned by its members rather than shareholders, with a commitment to serving the interests of its members and the communities it serves.

One of the key offerings from Nationwide Building Society is its loan products, which cater to both personal and business borrowing needs.

These loans are designed to provide individuals and businesses with access to funds for various purposes, such as home improvements, debt consolidation, purchasing a vehicle, or financing business ventures.

Personal loans from Nationwide typically come with competitive interest rates, flexible repayment terms, and a straightforward application process.

Borrowers can choose from fixed or variable interest rates and select repayment periods that suit their budget and financial goals.

Nationwide personal loans are often available for amounts ranging from small to large sums, depending on the borrower’s needs and eligibility.

For businesses, Nationwide offers a range of financing options, including commercial loans, asset finance, and business overdrafts.

These products are tailored to meet the unique needs of businesses across different industries and stages of growth, providing access to capital for expansion, equipment purchase, working capital, and other business purposes.

Nationwide prides itself on its commitment to responsible lending practices, conducting thorough affordability assessments and credit checks to ensure that borrowers can afford their loan repayments.

This helps protect borrowers from taking on debt they cannot manage and safeguards the financial health of the organization.

Coventry Building Society

Coventry Building Society is a well-established mutual financial institution based in the United Kingdom, known for its commitment to providing a range of financial products and services to its members.

Founded in 1884, Coventry Building Society operates as a mutual organization, owned by its members, and prides itself on delivering excellent customer service and value.

Among its array of financial offerings, Coventry Building Society provides loan products designed to meet the borrowing needs of individuals and businesses.

These loans cover various purposes, such as home improvements, debt consolidation, purchasing a vehicle, or financing other significant expenses.

Personal loans from Coventry Building Society typically feature competitive interest rates, flexible repayment terms, and a straightforward application process.

Borrowers can choose from fixed or variable interest rates and select repayment periods that align with their financial circumstances and goals.

Coventry personal loans may be available for varying amounts, depending on the borrower’s eligibility and requirements.

For businesses, Coventry Building Society offers tailored financing solutions, including commercial loans, buy-to-let mortgages, and business overdrafts.

These products are designed to support businesses across different sectors and stages of growth, providing access to capital for expansion, investment in equipment, working capital, or other business needs.

Coventry Building Society places a strong emphasis on responsible lending, conducting thorough affordability assessments and credit checks to ensure that borrowers can manage their loan repayments effectively.

This approach helps protect borrowers from taking on excessive debt and contributes to the financial stability of the organization.

Furthermore, Coventry Building Society is known for its member-focused approach, providing personalized support and guidance throughout the loan application and repayment process.

Members can access online tools and resources to manage their loans efficiently and make informed financial decisions.

Amigo Loans

Amigo Loans is a UK-based lender specializing in guarantor loans, providing an alternative borrowing option for individuals who may have difficulty accessing traditional bank loans due to a lack of credit history or poor credit rating.

Established in 2005, Amigo Loans has quickly become a prominent player in the UK lending market, offering loans with a unique guarantor-based model.

The concept of a guarantor loan involves a third party, typically a friend or family member, who agrees to step in and cover loan repayments if the primary borrower is unable to do so.

This provides additional security for the lender, allowing them to offer loans to individuals who may not meet the typical criteria for unsecured loans.

One of the key features of Amigo Loans is its focus on responsible lending practices.

While borrowers may have limited credit history or past financial difficulties, Amigo Loans conducts thorough affordability assessments to ensure that borrowers can afford their loan repayments without experiencing financial hardship.

Amigo Loans offers flexible loan terms, allowing borrowers to choose repayment periods that suit their budget and financial circumstances.

Loan amounts typically range from £500 to £10,000, with repayment periods of up to five years.

Interest rates are fixed for the duration of the loan, providing borrowers with certainty and predictability in their repayments.

The guarantor plays a crucial role in the Amigo Loans process, providing an additional layer of security for the lender.

Guarantors are required to have a good credit history and stable financial position, demonstrating their ability to cover loan repayments if the borrower defaults.

Guarantors do not need to provide any upfront collateral or assets to secure the loan.

Amigo Loans prides itself on its transparent and customer-centric approach, providing borrowers and guarantors with clear information about the loan terms, repayment schedule, and obligations involved.

The company offers personalized support and guidance throughout the loan application and repayment process, ensuring that borrowers and guarantors feel confident and informed every step of the way.

Bamboo Loans

Bamboo Loans helps people borrow money when they can’t get it from regular banks. They’re different because they look at each person’s situation individually, not just their credit score.

They offer two kinds of loans: ones where you don’t need to put anything as security, and ones where you need someone to promise to pay if you can’t.

Applying is easy, and they give you an answer fast. They make sure you can afford to pay back what you borrow, and they’re clear about all the costs.

They’re friendly and ready to help if you have any questions.

Overall, Bamboo Loans is there to help people get the money they need, even if other places have said no.

Tesco Bank

Tesco Bank is like a part of Tesco, the big supermarket chain. They offer banking services, like savings accounts, loans, credit cards, and insurance.

Tesco Bank is known for being convenient and easy to use, with things like online banking and a mobile app.

They also have customer service that’s available to help with any questions or problems you might have.

So, if you’re already shopping at Tesco and want to manage your money all in one place, Tesco Bank might be a good option for you.

Sainsbury Bank

Sainsbury Bank is a part of Sainsbury, the popular supermarket chain. They offer various financial services, including loans.

Sainsbury Bank loans are designed to help people borrow money for things like home improvements, buying a car, or consolidating debts.

Applying for a loan with Sainsbury Bank is easy, and you can do it online or in-store. They offer competitive interest rates and flexible repayment options, so you can choose what works best for your budget.

Sainsbury Bank loans come with clear terms and conditions, so you know exactly what you’re getting into.

Their customer service is known for being helpful and friendly, so you can get support if you need it.

QuickQuid

QuickQuid was a short-term lender in the UK that provided payday loans to customers.

They offered small, short-term loans to individuals who needed quick cash to cover unexpected expenses or emergencies.

Customers could apply for loans online, and if approved, receive the funds within a short timeframe, often on the same day.

QuickQuid faced significant controversy and regulatory scrutiny due to their high-interest rates and aggressive lending practices. Critics argued that their loans carried extremely high costs, leading some borrowers into cycles of debt.

In October 2019, QuickQuid parent company, CashEuroNet UK, entered administration following an influx of complaints and regulatory action.

As a result, QuickQuid ceased operating, leaving existing customers and outstanding loans in limbo.

The closure of QuickQuid served as a reminder of the risks associated with payday loans and the importance of responsible lending practices.

It also highlighted the need for consumers to carefully consider their options and explore alternative sources of financing that offer more affordable terms and better consumer protections.

Wonga

Wonga was a prominent short-term lender in the UK, offering payday loans to individuals in need of quick cash.

The company gained popularity for its fast and convenient online application process, allowing borrowers to access funds within minutes of approval.

Wonga’s payday loans were designed to be repaid in full, along with interest, on the borrower’s next payday.

While this provided a temporary solution for financial emergencies, critics raised concerns about the high-interest rates and fees associated with Wonga loans, which could result in significant costs for borrowers.

Despite its initial success, Wonga faced criticism and regulatory scrutiny over its lending practices.

In 2014, the Financial Conduct Authority (FCA) imposed stricter regulations on the payday lending industry, including caps on interest rates and fees, in an effort to protect consumers from excessive borrowing costs.

In August 2018, Wonga announced its decision to enter administration following a surge in compensation claims related to irresponsible lending practices.

The company closure left thousands of customers with outstanding loans and raised questions about the ethics of payday lending.

The downfall of Wonga served as a cautionary tale about the risks associated with high-cost short-term loans and highlighted the need for greater regulation and consumer protection in the lending industry.

It also underscored the importance of exploring alternative sources of financing that offer more affordable and sustainable borrowing options.

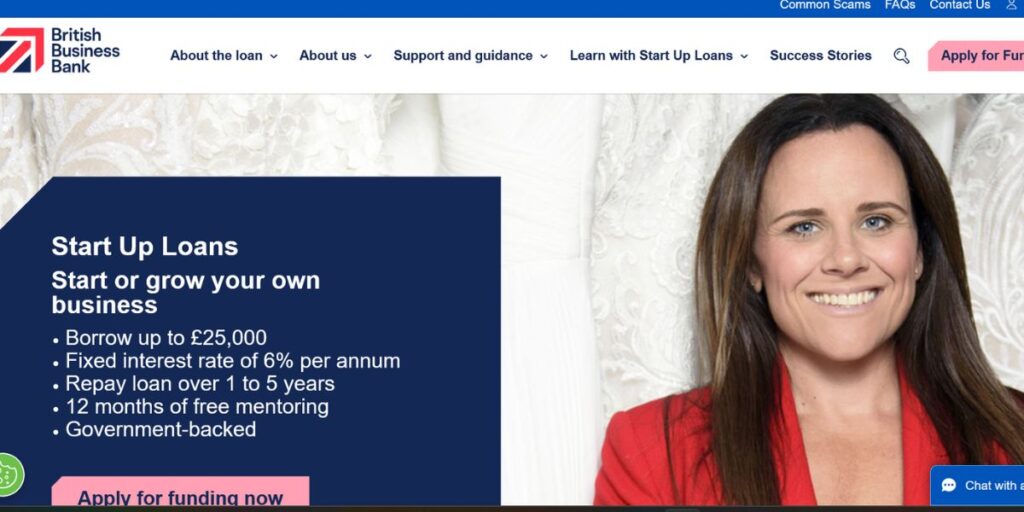

Start Up Loans scheme

The Start Up Loans scheme is a government-backed initiative in the United Kingdom aimed at supporting aspiring entrepreneurs in starting their own businesses.

Launched in 2012, the scheme provides access to low-interest loans, mentoring, and resources to help individuals turn their business ideas into reality.

One of the primary objectives of the Start Up Loans scheme is to address the challenges faced by new entrepreneurs, such as limited access to traditional financing and a lack of business experience.

By offering affordable loans and tailored support, the scheme aims to empower individuals to start and grow successful businesses, contributing to economic growth and job creation.

The Start Up Loans scheme provides loans ranging from £500 to £25,000, with repayment terms of up to five years.

These loans can be used to cover various startup costs, including equipment, inventory, marketing, and working capital.

The scheme offers competitive interest rates, making it an attractive financing option for budding entrepreneurs.

Help to Buy scheme

The Help to Buy scheme is a government initiative in the United Kingdom aimed at helping first-time buyers and home movers purchase a property with a smaller deposit.

Launched in 2013, the scheme has provided financial assistance to thousands of individuals and families looking to get onto the property ladder.

There are two main components of the Help to Buy scheme:

- Help to Buy Equity Loan: Under this part of the scheme, the government lends buyers up to 20% of the cost of a newly built home (40% in London), provided the buyer contributes at least a 5% deposit. This loan is interest-free for the first five years, after which a low-interest rate is charged. The equity loan allows buyers to access higher loan-to-value mortgages, making homeownership more affordable.

- Help to Buy ISA: This part of the scheme is designed to help individuals save for a deposit on their first home. With a Help to Buy ISA, the government contributes a bonus of 25% on savings, up to a maximum of £3,000. This bonus is added when the individual decides to purchase a property, boosting their deposit amount.

The Help to Buy scheme has been instrumental in making homeownership more accessible to a wider range of people, particularly those struggling to save for a large deposit.

By reducing the upfront costs associated with purchasing a property, the scheme has helped many individuals and families achieve their dream of owning their own home.

Application Process in the UK

- Research: Look into different lenders and their loan options to find the best fit for you.

- Prepare: Get all the papers you need ready, like ID, proof of income, and bank statements.

- Apply: You can either apply online or go to a bank branch in person. Fill out the application form carefully.

- Credit Check: The lender will check your credit history to see if you’re reliable with money.

- Approval: If you meet the lender’s requirements, your application might get approved.

- Offer: If approved, you’ll get an offer with details like how much you can borrow, the interest rate, and how long you have to pay it back.

If you’re happy with the offer, sign the agreement. After signing, the lender will send the money to your bank account. Stick to the payment plan in the agreement to avoid extra charges.

If you’re unsure about anything, don’t hesitate to ask the lender’s customer service team for help.

Hey, I’m Ratiranjan Singha, the Creator of Myworldstuffs.com. I Offer in-Depth Articles and Guides that Help you to Understand Various Financial Concepts.