As of recent data, a substantial number of individuals in India express a need for loans to fulfill various financial objectives.

Statistics indicate that a significant portion of the population applies for loans annually, reflecting diverse financial needs and aspirations.

Personal loans are commonly sought for a multitude of purposes, including debt consolidation, home renovations or purchases, funding education expenses, covering medical emergencies, and financing weddings or other special events.

Mortgages remain a primary focus for many Indians, with aspirations of homeownership driving demand for home loans.

Small and medium-sized enterprises (SMEs) frequently require financing to start or expand their operations, contributing to the demand for business loans.

Agricultural loans play a crucial role in supporting farmers and rural communities, providing funds for agricultural activities, equipment purchases, and crop cultivation.

Additionally, auto loans are prevalent, enabling individuals to purchase cars, motorcycles, or other vehicles.

How to Apply Loan in India?

In India, you can apply for loans through various financial institutions, including:

- Banks: Major banks such as State Bank of India (SBI), HDFC Bank, ICICI Bank, and Axis Bank offer a wide range of loan products, including personal loans, home loans, and business loans.

- Non-Banking Financial Companies (NBFC): NBFCs like Bajaj Finance, Tata Capital, and Mahindra Finance provide loans to individuals and businesses, often with more flexible eligibility criteria compared to banks.

- Online Lending Platforms: Online lending platforms offer quick and convenient loan application processes. Examples include PaySense, IndiaLends, and EarlySalary.

- Peer-to-Peer (P2P) Lending Platforms: P2P lending platforms connect borrowers with individual investors willing to fund loans. Examples include Faircent and LenDenClub.

- Microfinance Institutions: Microfinance institutions like SKS Microfinance and Bandhan Bank offer small loans to individuals, especially those from low-income backgrounds, for various purposes such as income generation and education.

- Cooperative Banks: Cooperative banks, such as Saraswat Bank and Punjab & Maharashtra Cooperative Bank, provide banking and financial services to their members, including loans.

- Regional Rural Banks (RRB): RRB like Kerala Gramin Bank and Baroda Rajasthan Kshetriya Gramin Bank serve rural and semi-urban areas, offering loans tailored to the needs of agricultural and rural communities.

- Government-Sponsored Schemes: The Indian government offers various loan schemes to promote entrepreneurship, agriculture, housing, and education. Examples include Pradhan Mantri Mudra Yojana (PMMY), Pradhan Mantri Awas Yojana (PMAY), and Stand-Up India.

- Gold Loan Companies: Companies like Muthoot Finance and Manappuram Finance specialize in providing loans against gold ornaments and gold coins.

- Credit Card Companies: Some credit card issuers in India offer personal loans to their cardholders, such as HDFC Bank and ICICI Bank.

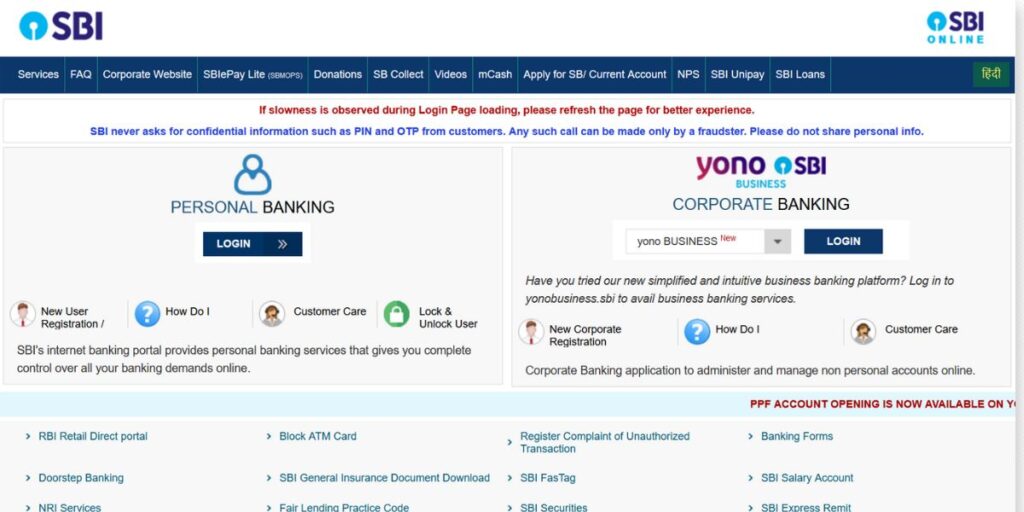

State Bank of India

The State Bank of India (SBI) is one of the oldest and largest banks in India, with a rich history that dates back to the early 19th century.

It was established as the Bank of Calcutta in 1806, primarily to serve the needs of the British colonial administration and facilitate trade and commerce in Calcutta (now Kolkata).

Over the years, the bank underwent several transformations and name changes, becoming the Bank of Bengal in 1809 and later the Bank of Bengal, Bombay, and Madras in 1921.

In 1955, the Indian government nationalized the Imperial Bank of India, which had evolved from the Bank of Bengal, and renamed it the State Bank of India.

Since its nationalization, SBI has played a pivotal role in the development of India’s banking sector and economy.

It has expanded its network of branches and services to reach every corner of the country, providing banking services to millions of individuals, businesses, and government entities.

SBI offers a wide range of financial products and services, including savings accounts, current accounts, credit cards, insurance, investment products, and loans.

HDFC Bank

HDFC Bank, officially known as Housing Development Finance Corporation Limited, is one of India’s leading private sector banks.

It was established in 1994 as part of the country’s efforts to liberalize its banking sector and promote private investment in financial services.

The bank was promoted by Housing Development Finance Corporation Limited, India’s premier housing finance institution established in 1977.

HDFC Bank was set up with the primary objective of providing banking services to retail customers, small and medium-sized enterprises (SMEs), and corporate clients.

Since its inception, HDFC Bank has experienced rapid growth and has become one of the largest and most profitable banks in India.

It has expanded its network of branches and ATMs across the country, reaching both urban and rural areas.

HDFC Bank offers a wide range of financial products and services, including savings accounts, current accounts, credit cards, insurance, investment products, and loans.

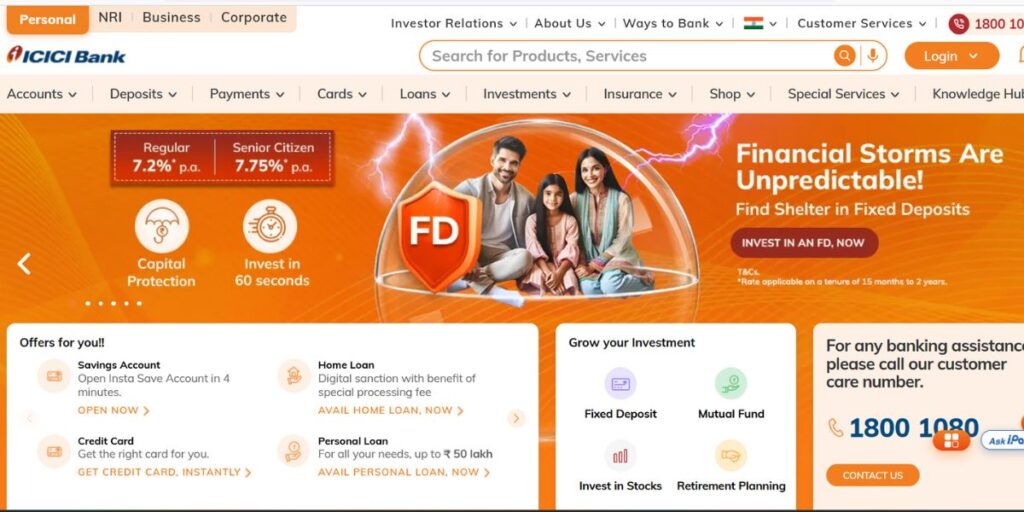

ICICI Bank

ICICI Bank, officially known as Industrial Credit and Investment Corporation of India Bank, is one of India’s largest private sector banks.

It was established in 1994 as a wholly-owned subsidiary of ICICI Limited, an Indian financial institution founded in 1955 to promote industrial development in the country.

ICICI Bank was set up with the objective of providing a wide range of financial services to retail customers, small and medium-sized enterprises (SMEs), and corporate clients.

It aimed to leverage technology and innovation to offer convenient and efficient banking solutions to its customers.

Since its inception, ICICI Bank has grown rapidly and expanded its presence across India and internationally.

It has established a vast network of branches, ATM, and digital banking channels, making its services accessible to customers in urban and rural areas alike.

ICICI Bank offers a comprehensive suite of financial products and services, including savings accounts, current accounts, credit cards, insurance, investment products, and loans.

Axis Bank

Axis Bank, formerly known as UTI Bank, is one of the leading private sector banks in India. It was established in 1993 as part of the country’s efforts to liberalize its banking sector and promote private investment in financial services.

Axis Bank was promoted by the Unit Trust of India (UTI), Life Insurance Corporation of India (LIC), General Insurance Corporation of India (GIC), National Insurance Company Ltd.

The New India Assurance Company Ltd., The Oriental Insurance Company Ltd. and United India Insurance Company Ltd.

It was one of the first private sector banks to be granted a license by the Reserve Bank of India (RBI) after the government’s decision to open up the banking sector to private players.

Since its inception, Axis Bank has grown significantly and has become one of the largest and most profitable banks in India.

It has expanded its network of branches, ATMs, and digital banking channels across the country, serving millions of customers in urban and rural areas.

Axis Bank offers a wide range of financial products and services, including savings accounts, current accounts, credit cards, insurance, investment products, and loans.

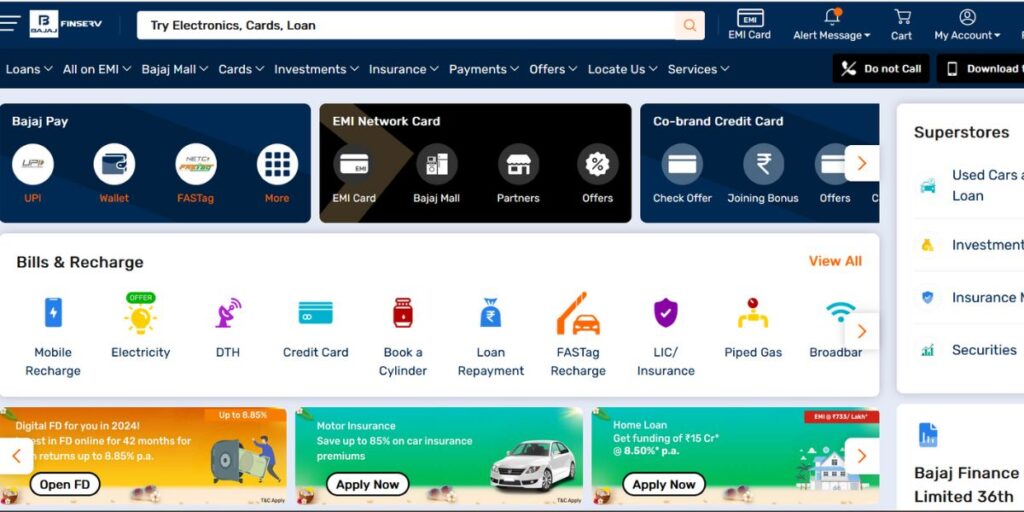

Bajaj Finance

Bajaj Finance Limited, a subsidiary of Bajaj Finserv Limited, is one of India’s leading non-banking financial companies (NBFCs).

The company was established in 2007 and quickly emerged as a prominent player in the financial services sector.

Bajaj Finance began its journey by offering consumer finance, personal loans, and other retail lending products.

Over time, it expanded its portfolio to include a wide range of financial products and services, catering to the diverse needs of consumers and businesses.

Tata Capital

Tata Capital Limited is a subsidiary of the Tata Group, one of India’s largest and most respected business conglomerates.

It was established in 2007 with the aim of providing a wide range of financial products and services to individuals, businesses, and institutions.

Tata Capital offers a diverse portfolio of financial solutions, including consumer loans, business loans, wealth management, and advisory services.

The company caters to the needs of retail customers, SMEs, corporates, and institutional clients, providing them with customized financial solutions tailored to their requirements.

Mahindra Finance

Mahindra Finance, officially known as Mahindra & Mahindra Financial Services Limited, is a subsidiary of the Mahindra Group, one of India’s largest conglomerates.

The company was established in 1991 with the aim of providing financial services to support the growth and development of rural and semi-urban areas in India.

Mahindra Finance initially focused on providing financing solutions for Mahindra Group vehicles, such as tractors and utility vehicles, to farmers and rural entrepreneurs.

Over time, the company expanded its portfolio to include a wide range of financial products and services catering to both rural and urban customers.

One of Mahindra Finance’s key offerings is its range of retail lending products, which includes personal loans, vehicle loans, and SME loans.

These loans are designed to provide individuals and businesses with access to affordable credit for various purposes, such as purchasing vehicles, financing small businesses, or meeting other personal needs.

PaySense

PaySense is a financial technology company that was founded in 2015 with the aim of providing accessible and convenient lending solutions to consumers in India.

The company recognized the need for hassle-free access to credit among individuals who may have difficulty obtaining loans from traditional banks due to factors such as limited credit history or lower credit scores.

PaySense offers personal loans through its online platform, leveraging technology to simplify the lending process and provide borrowers with a seamless experience.

The company platform allows individuals to apply for loans quickly and easily, receive instant approvals, and access funds within a short period of time.

IndiaLends

IndiaLends is a leading digital lending platform in India that was founded in 2015 with the mission of making credit more accessible and affordable for individuals across the country.

The company recognized the growing demand for convenient and transparent lending solutions, particularly among underserved segments of the population.

IndiaLends offers a wide range of financial products and services, including personal loans, credit cards, and credit reports, through its online platform.

EarlySalary

EarlySalary is a fintech company that was founded in 2015 with the goal of providing instant and hassle-free access to salary advances for individuals in India.

The company recognized the need for short-term credit solutions to address temporary cash flow challenges faced by salaried professionals between paychecks.

EarlySalary offers salary advance loans through its mobile app and website, allowing users to apply for loans quickly and conveniently from their smartphones or computers.

The application process is simple and straightforward, with borrowers providing basic personal and employment information to determine their eligibility for a loan.

Faircent

Faircent is India’s leading peer-to-peer (P2P) lending platform, established in 2014 with the objective of revolutionizing the lending landscape in the country.

The company recognized the growing demand for alternative lending solutions that provide both borrowers and lenders with more control, transparency, and better returns.

Faircent platform connects individual borrowers seeking loans with individual investors looking to lend money and earn returns on their investments.

By cutting out the middlemen and traditional financial institutions, Faircent aims to create a more efficient and cost-effective lending ecosystem that benefits both parties.

LenDenClub

LenDenClub is a peer-to-peer (P2P) lending platform in India, established in 2015 with the aim of providing accessible and transparent lending solutions to borrowers and investors.

The company identified the need for an alternative lending platform that connects individuals seeking loans with investors looking to earn attractive returns on their investments.

LenDenClub’s platform serves as a marketplace where borrowers can request loans for various purposes, such as debt consolidation, medical emergencies, education expenses, or business expansion.

Investors, on the other hand, can lend money to borrowers and earn interest on their investments, thereby diversifying their investment portfolios and potentially earning higher returns compared to traditional investment options.

SKS Microfinance

SKS Microfinance, now known as Bharat Financial Inclusion Limited, is one of India’s leading microfinance institutions (MFI), established in 1997 by Vikram Akula.

The company was founded with the mission of providing financial services to low-income individuals, particularly in rural and underserved areas, to help them improve their livelihoods and achieve financial inclusion.

SKS Microfinance initially operated as a non-profit organization, providing small loans to poor women for income-generating activities such as livestock rearing, small-scale farming, and handicraft production.

The organization’s innovative approach to microfinance, coupled with its focus on women empowerment and poverty alleviation, quickly gained recognition and support.

In 2005, SKS Microfinance transformed into a for-profit entity to attract investment capital and scale its operations to reach more clients.

The company adopted a business model focused on sustainable growth and profitability while continuing to prioritize social impact and financial inclusion.

SKS Microfinance expanded its product offerings to include a range of financial services, such as savings accounts, insurance, and remittance services, in addition to microloans.

Bandhan Bank

Bandhan Bank is a commercial bank headquartered in Kolkata, India, with a focus on serving underbanked and unbanked segments of the population.

It was established in 2014 as Bandhan Financial Holdings Limited, a non-banking financial company (NBFC), by Chandra Shekhar Ghosh.

Initially, Bandhan Financial Holdings operated as a microfinance institution (MFI), providing small loans to low-income individuals, particularly women, in rural and semi-urban areas.

The organization aimed to promote financial inclusion, empower women, and alleviate poverty by providing access to credit for income-generating activities.

In 2015, Bandhan Financial Holdings received approval from the Reserve Bank of India (RBI) to establish a full-fledged commercial bank.

Subsequently, it transformed into Bandhan Bank Limited and commenced operations as a scheduled commercial bank.

Bandhan Bank offers a wide range of banking products and services, including savings accounts, current accounts, fixed deposits, loans, and insurance products.

Saraswat Bank and Punjab

Saraswat Bank, established in 1918 in Maharashtra, stands as one of India’s oldest cooperative banks, rooted in the vision of community upliftment through financial support.

Over the decades, it has evolved into a comprehensive banking institution, catering to diverse banking needs with a strong emphasis on customer service and community development.

Conversely, Punjab & Maharashtra Co-operative (PMC) Bank, founded in 1984 in Maharashtra, shared a similar cooperative ethos, aiming to serve local communities.

However, PMC Bank encountered a significant setback in 2019 due to alleged irregularities and mismanagement, resulting in regulatory intervention and operational limitations.

While Saraswat Bank continues to thrive, offering a range of financial products including loans tailored to meet individual and business requirements, PMC Bank’s crisis underscored the challenges and risks inherent in the cooperative banking sector.

Maharashtra Cooperative Bank

Maharashtra Cooperative Bank is a prominent financial institution established in Maharashtra, India, with a rich history dating back to its inception.

Founded to serve the financial needs of the local community, the bank has played a significant role in the economic development of the region since its establishment.

Maharashtra Cooperative Bank began its journey as a cooperative society, driven by the cooperative movement’s principles of self-help and mutual assistance.

Over the years, it has expanded its operations and services to cater to a wide range of banking requirements, including deposits, loans, and other financial products.

Pradhan Mantri Mudra Yojana

The Pradhan Mantri Mudra Yojana (PMMY) is a flagship scheme launched by the Government of India in April 2015, aimed at facilitating the access of microfinance to small and micro-enterprises (SME).

The scheme’s primary objective is to provide financial assistance to entrepreneurs from marginalized and economically weaker sections of society, enabling them to start, expand, or upgrade their small businesses.

Under the PMMY, loans are provided by banks, non-banking financial companies (NBFC), microfinance institutions (MFI), and other financial intermediaries categorized into three categories or stages known as “Shishu” (up to ₹50,000), “Kishor” (up to ₹5 lakhs), and “Tarun” (up to ₹10 lakhs).

These loans are collateral-free and can be availed for various purposes, including business expansion, working capital requirements, purchase of equipment, machinery, or vehicles, and other business-related activities.

Pradhan Mantri Awas Yojana

The Pradhan Mantri Awas Yojana (PMAY) is a flagship housing scheme launched by the Government of India in June 2015, with the aim of providing affordable housing for all by the year 2022.

The scheme seeks to address the housing needs of urban and rural residents, particularly those from economically weaker sections (EWS), low-income groups (LIG), and middle-income groups (MIG).

PMAY comprises several components designed to cater to the diverse housing requirements of different segments of society.

These include the Credit Linked Subsidy Scheme (CLSS), which provides interest subsidy on home loans to eligible beneficiaries, making homeownership more affordable.

Additionally, PMAY encompasses the Beneficiary Led Construction (BLC) component, which assists eligible beneficiaries in constructing or enhancing their homes.

Under PMAY, eligible beneficiaries can avail of housing loans at subsidized interest rates from participating banks and financial institutions.

The scheme provides financial assistance and incentives to encourage the construction, purchase, and renovation of houses, promoting homeownership and improving living standards across India.

Stand-Up India

Stand-Up India is a flagship initiative launched by the Government of India in April 2016 with the aim of promoting entrepreneurship among women, Scheduled Castes (SC), and Scheduled Tribes (ST).

The scheme seeks to empower these marginalized sections of society by facilitating access to bank loans to start new enterprises or expand existing ones.

Under the Stand-Up India scheme, eligible entrepreneurs can avail of collateral-free loans ranging from ₹10 lakhs to ₹1 crore to establish greenfield enterprises in manufacturing, trading, or service sectors.

The scheme also provides support for non-individual enterprises, such as partnership firms, private limited companies, or limited liability partnerships (LLPs).

Muthoot Finance

Muthoot Finance Limited is one of India’s leading non-banking financial companies (NBFCs), specializing in gold loans and other financial services.

Established in 1939 by M. George Muthoot as a small trading business in Kerala, Muthoot Finance has grown into a prominent financial institution with a widespread presence across India.

The company initially focused on providing financing against gold jewelry, leveraging the cultural significance of gold in Indian households.

Over the years, Muthoot Finance expanded its operations and diversified its product offerings to include various loan products, such as personal loans, business loans, and housing loans, in addition to gold loans.

Manappuram Finance

Manappuram Finance Limited is a leading non-banking financial company (NBFC) in India, specializing in gold loans and other financial services.

Established in 1949 by the late V.C. Padmanabhan as a single branch in the town of Valapad, Kerala, Manappuram Finance has grown into a diversified financial institution with a pan-India presence.

The company began its operations by providing loans against household gold jewelry, leveraging the trust and cultural significance of gold in Indian households.

Over the years, Manappuram Finance expanded its product offerings to include various loan products, such as personal loans, business loans, vehicle loans, and housing loans, catering to the diverse financial needs of its customers.

Application Process in the India for loan

- Research: Start by looking at different lenders and the types of loans they offer. Compare interest rates, fees, and terms to find the best option for you.

- Preparation: Get all the documents you need ready, like ID, proof of income, and bank statements.

- Application: Apply for the loan either online through the lender’s website or by visiting a branch. Fill out the application form with your details.

- Credit Check: The lender will check your credit history to see if you’re good at paying back money.

- Assessment and Approval: The lender will look at your application and decide if they want to approve it. They’ll check things like your income, expenses, and credit history.

- Offer and Terms: If your application is approved, the lender will give you an offer with details like how much you can borrow, the interest rate, and how long you have to pay it back.

If you’re happy with the offer, sign the agreement to accept the loan.

After you accept the loan, the lender will transfer the money to your bank account.

This usually takes a few days. Stick to the payment plan they give you to avoid any extra charges.

If you have any questions or need help, reach out to the lender’s customer service team. They’re there to assist you.

Hey, I’m Ratiranjan Singha, the Creator of Myworldstuffs.com. I Offer in-Depth Articles and Guides that Help you to Understand Various Financial Concepts.