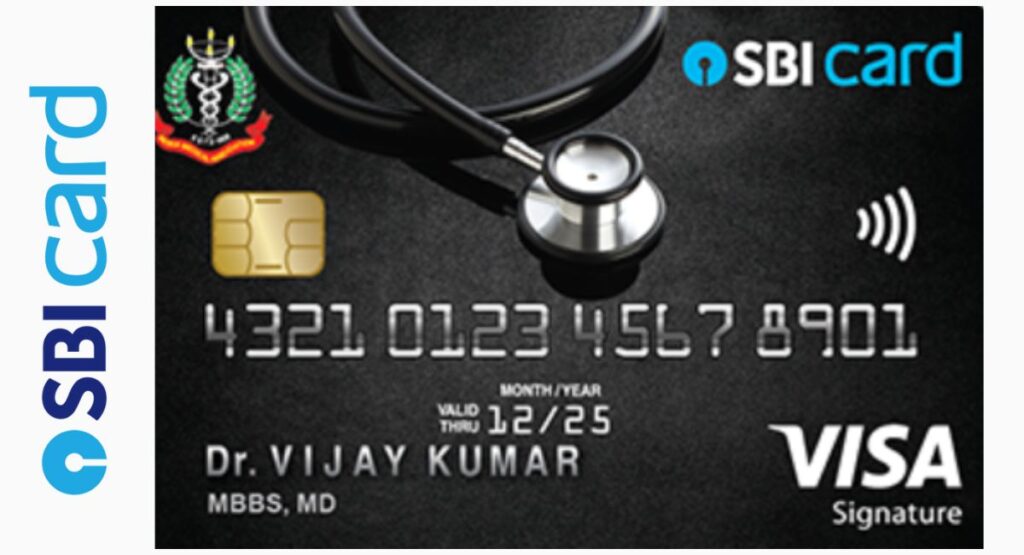

The Doctors SBI Card, in partnership with the Indian Medical Association (IMA), is an exclusive credit card tailored for healthcare professionals, particularly doctors and physicians.

This specialized card offers various benefits, including reward points on medical expenses and dining, welcome bonuses, and insurance coverage, such as air accident and medical insurance.

Cardholders can access exclusive offers and discounts related to medical services and lifestyle.

Being associated with the IMA provides networking opportunities within the medical community. The credit limit is determined based on income and credit history, with an annual fee that may be waived upon meeting specific spending criteria.

Doctors SBI Card: Benefits

The Doctor’s SBI Card, a collaborative effort with the Indian Medical Association (IMA), is specially crafted to cater to the unique needs of healthcare professionals.

This card offers a range of exclusive benefits, starting with 5X Reward Points on medical supplies, travel bookings, and international expenses.

Doctors also earn 5X Reward Points on their special day, Doctors’ Day, which falls on 1st July. For all other expenditures, they accumulate 1 Reward Point for every Rs. 100 spent.

This card provides a maximum cap of 7,500 Reward Points per month for each category. Beyond this cap, the standard Reward Points accrual applies.

Aside from rewards, Doctor’s SBI Card holders enjoy Visa privileges, including discounts at luxury hotels, car rentals, airport transfers, and more. The card also supports contactless payments for added convenience and security.

It’s accepted at millions of outlets worldwide, and in case of emergencies, card replacement services are available globally. Plus, cardholders can extend these benefits to their family members through add-on cards.

Access to cash across the world, enhanced security features, easy bill payments, flexible installment options, and balance transfer facilities make this card a valuable asset for medical professionals.

| Fees | Charges |

|---|---|

| Annual Fee (one-time) | Rs. 1,499 |

| Renewal Fee (per annum) | Rs. 1,499 |

| Fees and Charges | Refer to Terms & Conditions |

| Order of Payment Settlement | As per card policy |

| Cheque Payments | Local cheques or drafts payable in Delhi only |

| Taxation | Applicable taxes on all fees, interest, and charges |

| Co-Brand Arrangement | Fee and revenue sharing may apply based on the financial arrangement between SBI Card and the co-brand partner. |

Doctor’s SBI Card eligibility

To ensure that you meet the current eligibility criteria and to get the most accurate information, visit the official SBI Card website or contact SBI Card customer support before applying.

- You should be between the ages of 21 and 65 years.

- You should be a medical practitioner with recognized degrees like MBBS, MD, MS, DM, or equivalent.

- You should be a member of the Indian Medical Association (IMA).

- A good credit score is typically required for credit card approval. A credit score above a certain threshold, which may vary, is preferred.

- The specific income criteria can vary, but you should have a regular source of income to demonstrate your ability to repay the credit card dues.

- You should be a resident of India or an Indian citizen.

How to apply Doctor’s SBI Card?

Read the terms and conditions before applying for Doctor’s SBI Card. The application process may vary slightly depending on your location and the latest procedures, so it’s a good idea to check the official website or contact SBI Card customer support for the most up-to-date information.

Online Application for SBI Credit Card:

- Visit the SBI Card Website (www.sbicard.com).

- Browse through available credit card options.

- Select “Apply Now” next to your chosen credit card.

- Fill in the online application form with personal, contact, employment, and financial details.

- Upload required documents like identity proof, address proof, income documents, and photographs.

- Review your information and submit the application.

- Track your application status online.

Offline Application for SBI Credit Card:

- Visit a nearby SBI branch.

- Request an SBI credit card application form from bank staff.

- Fill in the form with personal and financial information.

- Attach copies of identity proof, address proof, income documents, and photographs.

- Submit the completed application form to the bank.

- Inquire about your application’s status through the branch or customer service.

Hey, I’m Ratiranjan Singha, the Creator of Myworldstuffs.com. I Offer in-Depth Articles and Guides that Help you to Understand Various Financial Concepts.